Solana Price Surges Despite $6.6 Million Sell-Off from Pump.fun

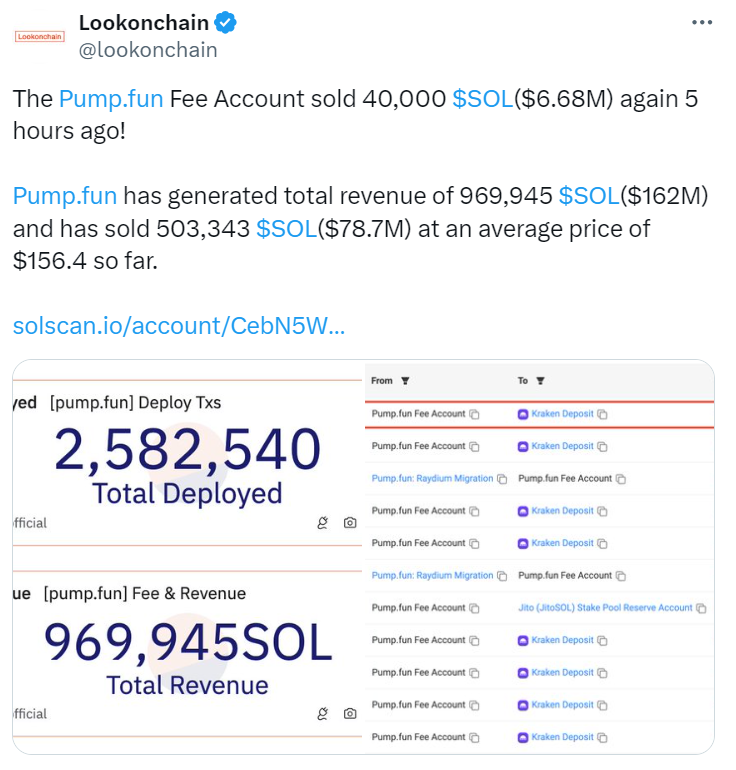

Solana Price Resilience – Solana’s price has demonstrated resilience despite ongoing selling pressure from the memecoin launch platform Pump.fun. On October 22, the fee account linked to Pump.fun sold over $6.6 million worth of Solana (SOL) tokens, totaling approximately 40,000 SOL. This sale comes as part of a broader trend, with Pump.fun generating a total revenue of 969,945 SOL (approximately $162 million) and having sold 503,343 SOL (around $78.7 million) at an average price of $156.4.

Despite these significant sales, Solana’s price has seen an increase of over 9.3% on the weekly chart, rising 0.8% in the 24 hours leading up to 11:18 AM UTC, trading at $165.8, according to data from Cointelegraph. The activity of whales—large crypto-holding entities—can greatly influence a cryptocurrency’s price movements, with traders often tracking whale selling patterns for insights into short-term price trends.

Is Pump.fun Pressuring Solana’s Price?

The persistent selling of SOL from the fee account associated with Pump.fun could be exerting pressure on Solana’s price. A notable decline occurred in the week leading up to September 4, when Solana’s price fell over 12% to $128 shortly after Pump.fun sold $41 million in SOL tokens at an average price of $157.5 per token. The platform currently holds another $47.9 million worth of Solana tokens, indicating potential for further selling pressure.

Memecoins: A Double-Edged Sword for SOL Price?

The current memecoin trend on Solana may be contributing to the pressure on SOL’s price. According to crypto trader and podcast host Luke Martin, Solana’s token rally transitioned into a stagnation phase once users began launching numerous meme tokens on Pump.fun. Martin noted in a September 4 X post that “when you overlay Pump.fun launches on top of the Solana price chart, $SOL stopped going up almost exactly when people started launching tons of memecoins.”

Nevertheless, there remains a growing anticipation surrounding a potential Solana-based exchange-traded fund (ETF), which could serve as the next significant catalyst for SOL’s price movement. Brazil’s first Solana ETF was approved on August 7, setting a precedent for other jurisdictions worldwide.

Leave a comment