Cardano Price Faces Critical Zone Amid Market Struggles and Potential $1.3 Billion ETH Sell-Off

As crypto markets grapple with downward pressure from Bitcoin’s sell-off, Cardano (ADA) finds itself in a crucial zone. Meanwhile, Ethereum (ETH) linked to the infamous PlusToken scam has recently been transferred to centralized exchanges, sparking fears of a significant sell-off. Given ADA’s strong correlation with ETH, will it be able to withstand the impact of a $1.3 billion liquidation?

Why the PlusToken $1.3 Billion ETH Dump Could Matter for Cardano

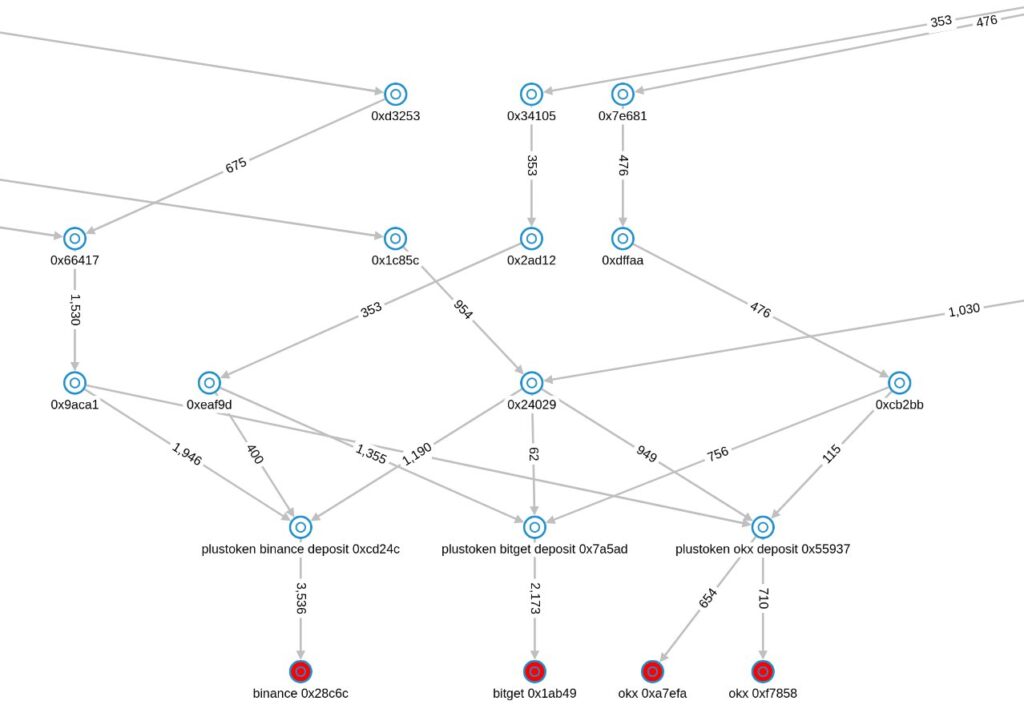

In early August, a large portion of ETH seized from the PlusToken scam became active on-chain for the first time since 2021. Over the last 24 hours, approximately 7,000 ETH of the remaining 542,000 ETH (worth $1.3 billion) has been moved to major exchanges, signaling a likely sell-off of the remaining stash.

At its peak, PlusToken had amassed around 830,000 ETH (then valued at $1.98 billion). This stash had remained mostly untouched until mid-2021, when about a third of the ETH was transferred to Bidesk, a lesser-known exchange, and was presumed to have been sold.

In the most recent movement, 15,700 ETH was transferred from known PlusToken addresses, with 7,000 ETH landing in the wallets of Binance, Bitget, and OKX. It’s anticipated that additional exchange addresses may become active, suggesting a steady liquidation process.

The sale of these assets could have far-reaching consequences, especially for Ethereum and other cryptos. Ethereum underpins a large portion of the decentralized finance (DeFi) space and decentralized applications (dApps). A substantial drop in its price could destabilize the broader market, affecting the performance of tokens that rely on it.

ADA’s Strong Correlation with ETH

Many altcoins have historically shown a high correlation with Ethereum’s price movements, and Cardano is no exception. According to the Crypto Correlation Tool, ADA has maintained a strong correlation with ETH over the last 90 days, ranking just behind Polkadot (DOT) in terms of correlation strength. Specifically, Cardano’s price correlation coefficient with Ethereum sits at 0.8, indicating a significant relationship between the two assets.

This means ADA is likely to react strongly to any fluctuations in ETH’s price. Over the past 24 hours, ADA has already dropped 1.9%, currently trading at $0.3395.

How Low Could Cardano Go If Ethereum Plummets to $1,950?

Should the PlusToken sell-off proceed, Ethereum’s price could face a sharp decline. Historically, we’ve seen large sales move markets—when the Ethereum Foundation offloaded $30 million in ETH, the price dropped by 4.8% in a single day. If $1.3 billion worth of ETH hits the market, estimates suggest the price could fall by 16.8%, potentially dragging Ether down to a new yearly low of $1,953.

Given the 0.8 correlation coefficient between ADA and ETH, a 16.8% drop in Ethereum could result in a 30.24% drop in Cardano, pushing ADA to around $0.23.

However, if the sell-off is delayed or does not materialize, Ethereum and the broader market could demonstrate strength. In this case, ADA could bounce back from its current price, with the potential to rally toward the upper trend line at $0.45, representing a 23.56% increase.

Of course, these projections are simplified and do not take into account other market variables, such as investor sentiment or broader macroeconomic factors. Ultimately, ADA’s price hangs in the balance, with a potential for significant upside or downside depending on the actions of Chinese authorities regarding the PlusToken funds.

Leave a comment