Can a Treasury Burn Propel Cardano’s Price?

Despite recent network upgrades and the implementation of full on-chain governance, Cardano’s price has struggled to gain upward momentum. As the community discusses the potential burning of 1.5 billion ADA from the Treasury, many are questioning whether this move could trigger a 23% price increase. With the broader cryptocurrency market experiencing volatility, could a Treasury burn provide the boost ADA needs to break free from its current downtrend?

Could ADA Burn Spark a Price Rally?

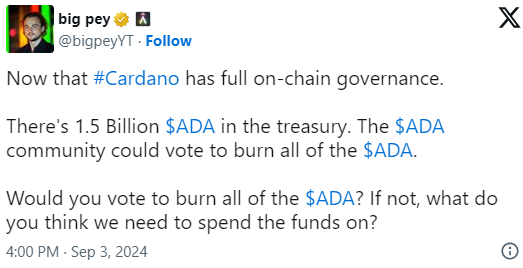

Prominent Cardano supporter Big Pey suggested that with the community now in full control of the network, a vote could be initiated to burn all 1.5 billion ADA in the Treasury. This potential burn represents around 3.3% of the total Cardano supply.

However, the proposal has sparked mixed reactions within the community. Some users have advocated for locking up 75% of the supply instead of burning the 1.5 billion coins. Others have outright dismissed the idea, arguing that such a move would mainly benefit short-term speculators rather than providing long-term value.

Meanwhile, Cardano founder Charles Hoskinson recently made critical remarks about Bitcoin’s future, suggesting that it might be better utilized on chains like Cardano, further intensifying the discussion around Cardano’s role in the broader crypto ecosystem.

ADA Price Struggles Amid Bullish Reversal Pattern

Despite the ongoing debates, ADA’s price continues to trend downward. Over the last 24 hours, Cardano’s price dropped 2.1% to $0.322, marking a 6% decline over the past month. This drop mirrors the overall cryptocurrency market, which has seen increased volatility following Bitcoin’s price dip below $57,000.

According to technical analysis, ADA is currently trading within a falling wedge pattern, a potential bullish reversal formation. The key support level sits around $0.30, with resistance at $0.34. Traders remain cautious, awaiting a confirmed breakout with sufficient volume before making significant moves.

As the Cardano community still processes the implications of the recent Chang hard fork, any formal proposal to burn ADA could have a notable impact on the asset’s price.

What’s Next for ADA?

Cardano’s price action is approaching the end of the falling wedge, leaving little room for further sideways movement. This narrowing of price action suggests that ADA will soon choose a direction—either breaking out to the upside or continuing its downward trend. While falling wedges are traditionally bullish patterns, a breakout to the downside remains possible if selling pressure persists.

Should the price break upward, ADA could surge 23% to the $0.40 level, with potential resistance at $0.35 and $0.37 on the way up.

In conclusion, between Bitcoin’s volatile price swings and the ongoing developments within the Cardano network, ADA remains a highly watched asset. However, for investors, it remains a risky bet as any significant updates—positive or negative—could sharply influence its price trajectory.

Leave a comment