Crypto News – BTC‘s price fell to $41,189 during Asia’s trading hours, according to data from CryptoSlate, echoing the beginning of the week’s most valuable digital asset. Comparably, during trading hours, significant losses of 2% to 5% were reported by several large-cap alternative cryptocurrencies, including Ethereum, Solana, Cardano, and Avalanche.

Ordinals Minting Clogs Network, Bitcoin Price Plummets

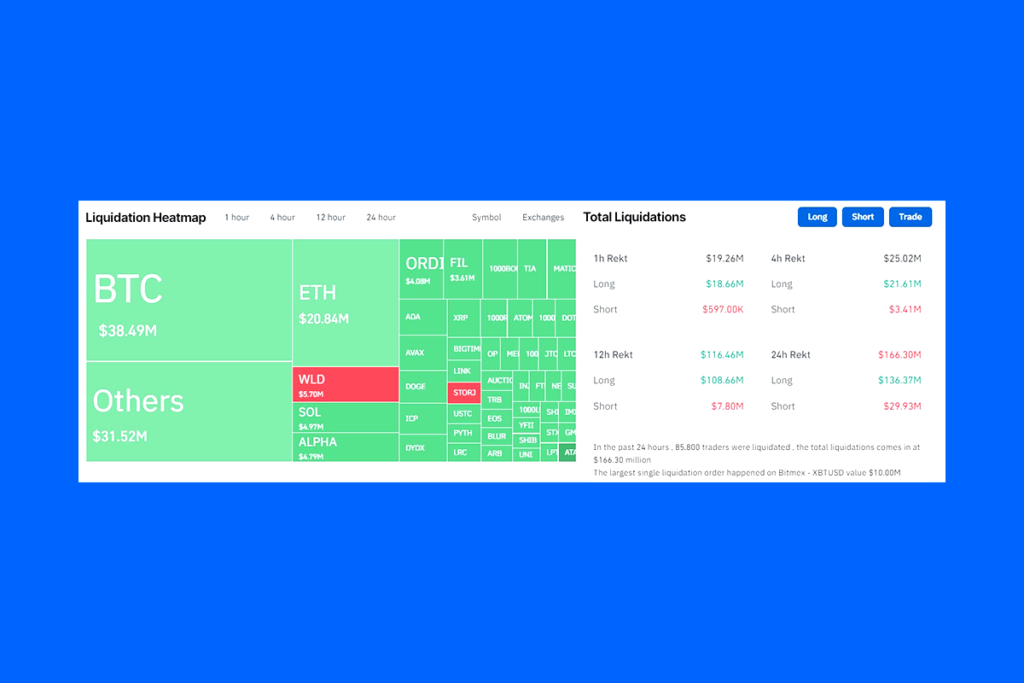

According to Coinglass data, almost 85,000 active cryptocurrency traders lost about $166 million as a result of the recent price decrease. According to the breakdown of these liquidations, short traders lost $30 million, and long traders lost $136 million, which represents the largest losses.

Losses from various Bitcoin positions amounted to more than $40 million for traders. This amount was made up of $38 million from long positions, or traders betting on greater Bitcoin prices, and $7 million from short positions, or traders betting on lower prices.

Ordinals Inscriptions Transactions Clog Blockchain Network

Of all the exchanges, the biggest losers were Binance and OKX, with liquidations totaling more than $74 million and $42 million, respectively. Notably, a $10 million-long wager on the price of Bitcoin through BitMEX resulted in the largest single loss. With a low Liquidation Sensitivity Index (LSI) score of approximately $15.5 million USD, Bitcoin continues to be less leveraged than it was during the 2021 bull run when an average of $74 million was liquidated for every 1% change in the price of the cryptocurrency.

According to BitInfoCharts statistics, an increase in Ordinals Inscriptions over the weekend caused a clogged blockchain network, which increased the average transaction price on Bitcoin to over $37. Furthermore, according to Mempool data, as of the time of publication, these transactions had resulted in over 288,000 unconfirmed transactions.

Leave a comment