Crypto News– ATOM Crypto: In its latest move, Grayscale made adjustments to its investment portfolios by eliminating Cardano’s token from its Grayscale Digital Large Cap Fund (GDLC) and removing Cosmos’ token from its Grayscale Smart Contract Platform Ex-Ethereum Fund (GSCPxE).

The Grayscale fund removes ADA token and ATOM Crypto following quarterly rebalancing

This strategic decision was disclosed through an announcement on April 4 on the X platform, where Grayscale, the world’s leading crypto-focused asset manager, detailed its quarterly fund rebalancing activities. As part of this routine rebalancing process, Grayscale liquidated the positions of Cardano and Cosmos tokens within the respective funds. The proceeds generated from these token sales were subsequently reinvested into existing components of the funds, aligning with Grayscale’s investment strategy and market outlook. This move underscores Grayscale’s commitment to actively manage its investment products to optimize portfolio performance and adapt to changing market conditions in the dynamic cryptocurrency landscape.

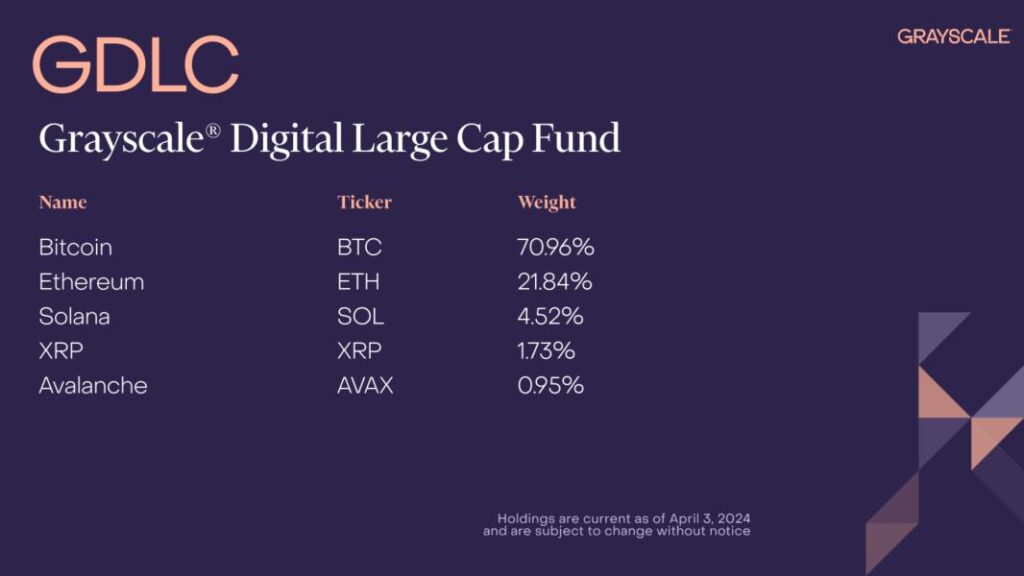

Following the removal of the ADA token, Grayscale’s large-cap fund has undergone a significant shift in its composition. The fund now boasts a robust portfolio, with Bitcoin dominating the allocation at 70.96%, showcasing its status as the leading cryptocurrency. Ethereum follows closely behind, constituting 21.84% of the fund, highlighting its prominent position in the digital asset space. Solana, with its innovative blockchain technology, holds a notable 4.52% share, demonstrating its growing popularity among investors. Meanwhile, XRP and Avalanche contribute 1.73% and 0.95%, respectively, rounding out the diversified portfolio. This strategic restructuring underscores Grayscale’s commitment to adapt to market dynamics and optimize its investment strategy to enhance returns for its investors. By carefully rebalancing its portfolio, Grayscale aims to position itself advantageously in the evolving cryptocurrency landscape, thereby maximizing value and mitigating risks.

As for Grayscale’s smart contract platform fund, it has undergone a notable transformation in its asset composition. Presently, the fund boasts a diversified portfolio, with Solana commanding the largest allocation at 58.41%, reflecting the growing prominence of its blockchain ecosystem. Cardano follows suit with a substantial 14.56% share, showcasing its significance as a leading smart contract platform. Additionally, Avalanche, Polkadot, and Polygon contribute 12.25%, 8.53%, and 6.25%, respectively, further diversifying the fund’s holdings. The removal of ATOM from the fund underscores Grayscale’s strategic approach to portfolio management, aiming to optimize returns and mitigate risks in line with evolving market trends.

In contrast, Grayscale’s DeFi Fund has remained relatively stable, with no new assets added or removed. The fund maintains a balanced allocation across various decentralized finance (DeFi) protocols. Notably, Uniswap commands the largest share at 48.74%, reflecting its pivotal role in decentralized exchanges. Maker, Lido, Aave, and Synthetix follow closely behind, contributing 20.41%, 13.17%, 9.99%, and 7.69%, respectively, showcasing the fund’s exposure to diverse DeFi offerings. This consistent approach underscores Grayscale’s commitment to providing investors with exposure to the burgeoning DeFi sector while maintaining a well-rounded and diversified investment portfolio.

Grayscale stands as the foremost crypto-focused asset manager globally, renowned for its expertise in navigating the complexities of the digital asset landscape. In a strategic move reflecting the evolving dynamics of the cryptocurrency market, Grayscale unveiled its latest offering, the Grayscale Dynamic Income Fund, at the close of March. This innovative investment fund is tailored to prioritize cryptocurrencies offering staking rewards, capitalizing on the burgeoning trend of yield generation within the crypto sphere.

However, it’s worth noting that access to the Grayscale Dynamic Income Fund is limited to select clientele, underscoring Grayscale’s commitment to serving high-net-worth individuals and institutional investors. Specifically, the fund is exclusively available to clients boasting assets under management exceeding $1.1 million or possessing a net worth surpassing $2.2 million. This eligibility criterion reflects Grayscale’s strategic approach to catering to sophisticated investors seeking exposure to innovative investment opportunities within the crypto market while upholding rigorous standards for investor qualification and portfolio management.

ADA token and ATOM Crypto Experience Year-to-Date Losses in Returns

Year-to-date, Cardano’s ADA token has experienced an 8.1% decline, while ATOM Crypto has seen a drop of over 3.3%. These losses notably lag behind the performance of Bitcoin and Ether, with Bitcoin up 59% and Ether rallying over 40% since the start of the year, according to TradingView data.

On a weekly chart, ADA is down by more than 10%, slipping below the psychological threshold of $0.6 on April 2nd. Currently, it stands 81% below its previous all-time high of $3.10, reached in September 2021.

Leave a comment