Crypto Market Sees Massive $921M Inflows Amid Federal Reserve Rate Cut Speculation

The crypto market recorded a massive $921 million in inflows last week, marking one of its strongest performances in 2024. The surge came as investors grew increasingly confident about a potential U.S. Federal Reserve rate cut, following softer-than-expected inflation data that boosted risk appetite across digital assets.

Macroeconomic Signals Ignite Crypto Inflows

Investor sentiment in the digital asset market turned notably bullish after U.S. CPI data pointed to cooling inflation, reinforcing bets that the Federal Open Market Committee (FOMC) could cut interest rates by 25 basis points at its next meeting — with odds nearing 97%.

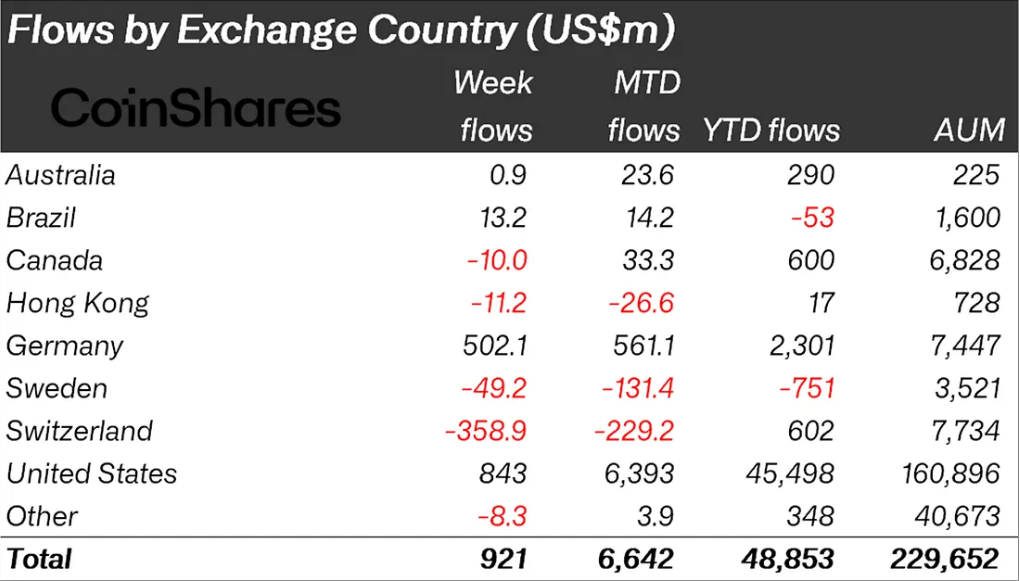

According to the Digital Asset Fund Flows Weekly Report, U.S. inflows dominated with $843 million, while Germany followed with a near-record $502 million. Meanwhile, Switzerland saw $359 million in outflows, mostly due to asset provider transfers rather than actual selling.

Global ETP trading volumes jumped to $39 billion, far above the 2024 average, signaling increased market participation. Analysts say the data show how closely investors are tracking macroeconomic indicators and Federal Reserve guidance in shaping short-term crypto sentiment.

Bitcoin Leads While Ethereum Sees Outflows

Bitcoin (BTC) continued to dominate institutional flows, attracting $931 million in inflows last week — pushing its total to $9.4 billion since the first hints of Fed easing appeared. Year-to-date inflows across all digital assets reached $30.2 billion, though still below the $41.6 billion record from last year.

In contrast, Ethereum (ETH) posted its first outflows in five weeks, losing $169 million. Despite that, demand for 2x leveraged Ethereum ETPs remained strong, showing that advanced traders are still betting on near-term volatility and upcoming ETF launches for Solana (SOL) and XRP.

Flows into Solana and XRP slowed as investors awaited U.S. ETF approval decisions. Still, the overall jump in ETP trading volumes highlights growing confidence from both retail and institutional investors, reinforcing crypto’s role as a key barometer of risk sentiment amid shifting macroeconomic conditions.

Comments are closed.