Crypto Exchange Kraken Plans $500 Million Funding at $15B Valuation Ahead of 2026 IPO

Crypto exchange Kraken is reportedly preparing a massive $500 million funding round, targeting a valuation of $15 billion, as the company gears up for a potential public listing in early 2026, according to sources cited by The Information.

The U.S.-based platform was last valued at around $11 billion in 2022, and its latest fundraising ambitions signal growing investor interest amid a broader crypto IPO boom.

IPO Momentum Builds in Crypto Sector

The IPO market has seen renewed excitement in 2025, especially for crypto and fintech platforms. Circle, the issuer of stablecoin USDC, launched a $1 billion public offering in June, soaring over 484% since debuting at $31 on the New York Stock Exchange.

Similarly, eToro, a trading platform for crypto and stocks, went public on Nasdaq in May at $52, climbing 16.5% to close at $60.71. Meanwhile, Coinbase (COIN), Kraken’s main U.S. rival, has surged 50% year-to-date, and Robinhood (HOOD) has skyrocketed 162% in 2025.

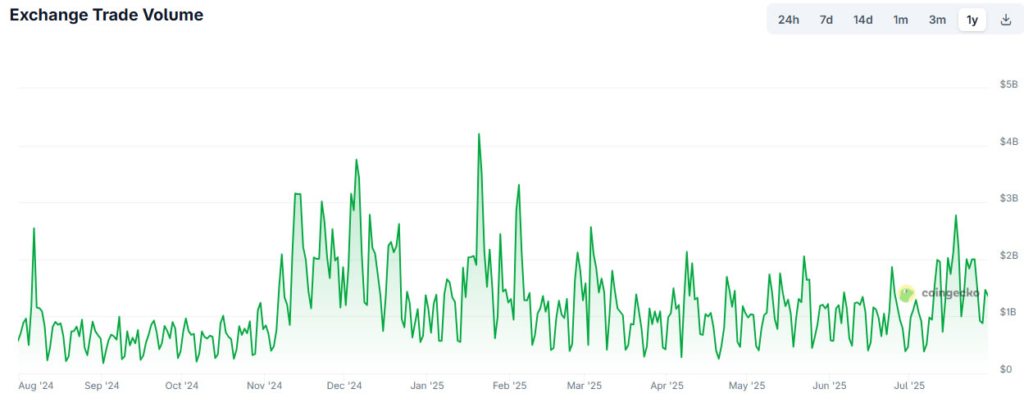

Kraken’s own daily trading volume currently sits at approximately $1.37 billion, with over 1,100 trading pairs—about half of Coinbase’s $2.77 billion volume.

Regulatory Shift and European Expansion Fuel Growth

Kraken’s IPO ambitions come as crypto regulations in the U.S. ease. In March, the SEC dropped its lawsuit against Kraken, part of a broader rollback of enforcement actions under the Trump administration.

Several other crypto firms, including Ripple, Gemini, Grayscale, and Bullish, are also reportedly considering public listings, encouraged by a more favorable regulatory environment.

In June, Kraken expanded its global reach with the launch of “Krak”, a peer-to-peer payments app, and obtained a key license under the Markets in Crypto-Assets (MiCA) framework, allowing it to offer services across the EU.

Comments are closed.