CRCL Faces Sharp Pullback Amid Market Volatility

Circle (CRCL) has returned to its opening price, erasing almost all of its post-IPO gains. Despite solid third-quarter earnings and faster USDC growth, this decrease has occurred. Growing supply pressure from insider unlocks, market volatility, and macroeconomic uncertainty is highlighted by the recent downturn. Institutional investors are still expressing confidence in Circle’s long-term growth and domination as a stablecoin.

Circle Stock Collapses After IPO Lockups Expire

As the only major stablecoin issuer that was accessible to the public, Circle attracted a lot of attention from investors after its early June IPO. After initially rising to highs close to $240, shares fell back to $31, thus completing the stock’s entire post-IPO gain. One of the main factors increasing selling pressure, according to market participants, is the expiration of early investor lockups. Short-term volatility has also increased due to macroeconomic worries and conjecture about the impending rate-cut cycle.

Circle’s Fundamentals Surge Despite Price Drop

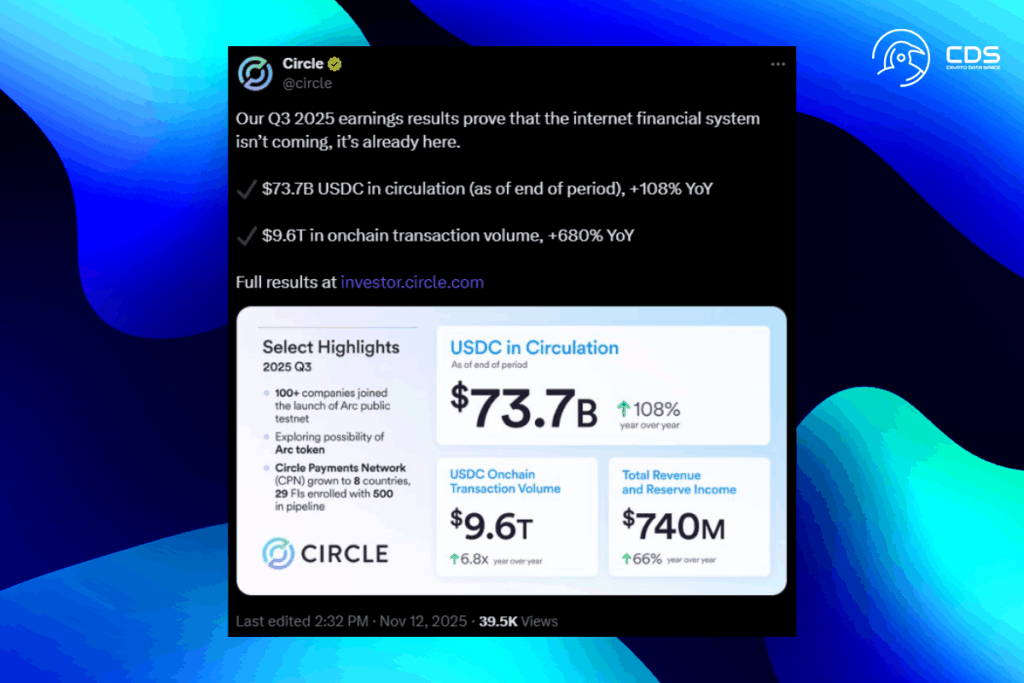

Circle‘s primary metrics are still strong despite the retracement:

- Circulation reached $74 billion, up 108% from the previous year.

- Revenue reached $740 million, up 66% year over year.

- Adjusted EBITDA was $166 million, up 78% year over year.

This demonstrates the platform’s increasing financial performance and usage. Moreover, bullish bets are still being taken by institutional investors, such as JPMorgan and Cathie Wood’s Ark Invest. Their interest shows that they have faith in Circle’s strategic Arc alliances and possible future revenue streams.

Seeing quite a bit of FUD from Circle investors lately, mostly driven by price action. Some are also concerned about the upcoming rate cut cycle, which could continue to pressure Circle’s earnings. That’s a mid-curved take, though imo,

MoonRock Capital founder Simon Dedic

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.