Chainlink Price- Chainlink at Make-or-Break Resistance Level

Chainlink Price– Chainlink (LINK) has encountered significant selling pressure as escalating tariff tensions weigh heavily on market sentiment. Over the past week, the token has struggled to find upward momentum, with traders increasingly adopting a bearish stance.

Traders Favor Short Positions Over Long

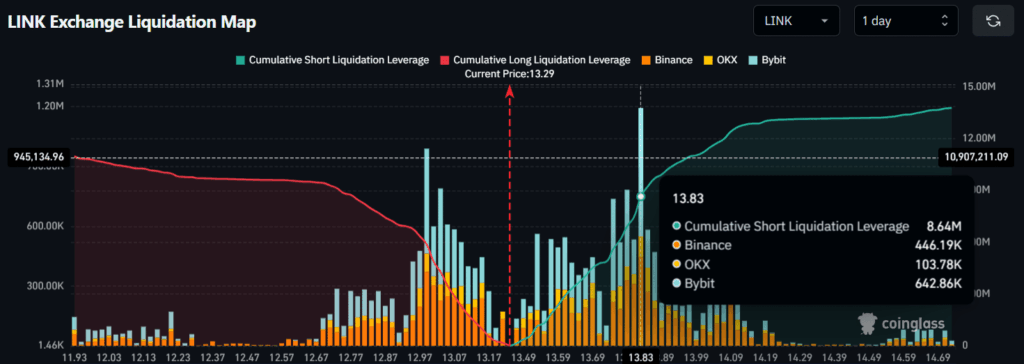

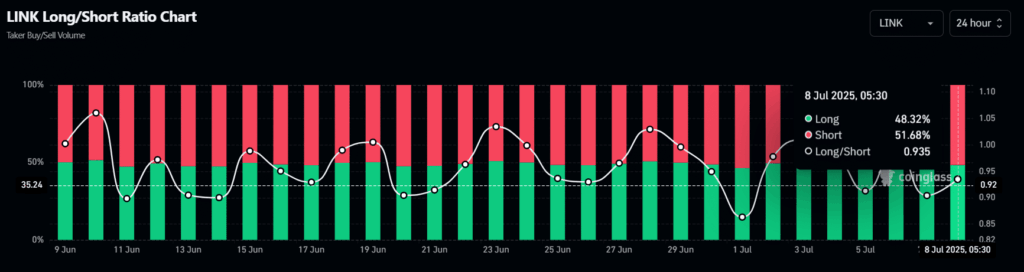

According to on-chain analytics platform CoinGlass, as of July 8th, traders have been predominantly bearish on LINK. Data shows that while $5.87 million worth of long positions remain open, short positions surpass this with $8.64 million, reflecting a cautious market mood. The Long/Short ratio currently stands at 0.935, indicating that 51.68% of traders are positioned short compared to 48.32% betting on long positions.

At key price levels, significant leverage was noted: $12.99 acting as support and $13.83 as resistance, both witnessing strong trading interest.

LINK’s price has dipped slightly, trading around $13.49 at the time of reporting, marking a decline of over 0.55% in 24 hours. This drop, alongside tariff-related concerns, has dampened market participation. CoinMarketCap data indicates a 12% decrease in LINK’s trading volume compared to the previous day, signaling reduced activity.

Technical Outlook: Critical Resistance Levels in Focus

Technical analysis from AMBCrypto highlights that LINK is at a crucial juncture. The token has consolidated in a narrow range for over two weeks and is now testing a descending trendline that historically serves as a strong resistance. This is the fourth attempt at breaking this level, with past encounters resulting in price rejections and declines.

Should bearish momentum persist and Chainlink (LINK) falls below $12.70, the asset could face an extended downturn, potentially seeing a 17% correction. Conversely, breaking above this resistance and closing a daily candle over the trendline may pave the way for a bullish reversal.

Currently, Chainlink (LINK) trades below the 200-day Exponential Moving Average (EMA), underscoring the prevailing downtrend. A sustained move above the 200 EMA and the $16 resistance level would be required to confirm a positive shift in market dynamics.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.