Celestia Hype Fades: On‑Chain Data Hints at More Sell‑Off Pain Ahead

With a high-profile airdrop and compelling stories about modular blockchain architecture, Celestia (TIA) exploded into the cryptocurrency landscape. But as TIA deals with increasing sell pressure and growing doubt regarding its tokenomics, the enthusiasm has swiftly subsided. Concerns regarding the project’s long-term value sustainability have been raised as early recipients of the airdrop have gradually sold off their holdings, speeding up the downward pace.

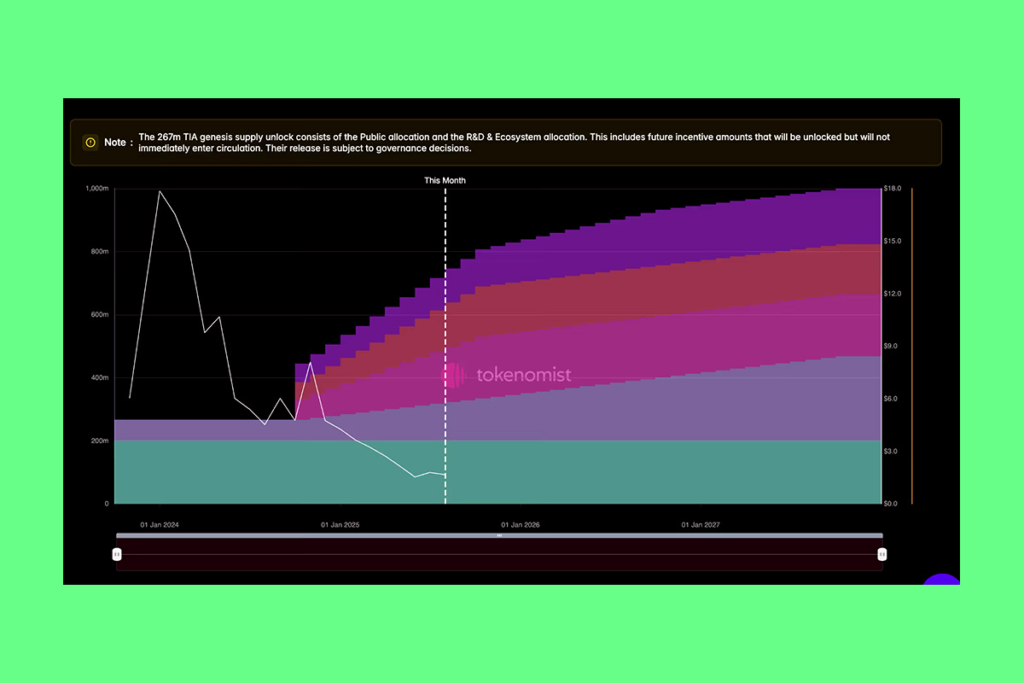

According to on-chain data, a sizable percentage of tokens are still held by insiders and early investors, raising concerns about more dilution as next unlocks get near. Market sentiment suggests that Celestia’s economic architecture may require modifications to preserve investor confidence, even while the company’s technical vision is still encouraging.

Celestia’s Airdrop Frenzy Turns Sour as Sell‑Offs Drain Market Strength

Strong retail involvement was initially fueled by Celestia‘s airdrop, but the market has been under constant pressure due to the quick supply surge. Sell-offs have increased in the absence of a robust organic demand counterweight. Airdrop farmers and whales have been eager to cash out, which has reduced liquidity and made it more difficult for new buyers to build solid positions. The difficulties encountered by other airdrop-heavy launches, when temporary enthusiasm does not result in long-term price growth, are shown in this trend.

TIA’s Path to Recovery: Why Is Tokenomics Overhaul Critical?

Making deliberate adjustments to its token release schedule, staking incentives, and ecosystem expansion goals could be crucial to Celestia’s recovery. By promoting genuine utility for TIA and reducing sell pressure through longer lock-ups, price action may become more stable. In order to ensure sustainable growth, the team will need to show institutional and long-term retail investors that it is willing to modify its economic model. If nothing is done, TIA could end up being just another example of how tokenomics can make or ruin a good blockchain startup.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.