Featured News Headlines

Canton (CC) Gains Momentum with Exchange Listings and Privacy Focus

Canton (CC) emerged as the top-performing cryptocurrency over the past 24 hours, recording a 15% price increase to reach approximately $0.087 during early Asian trading hours on Monday, November 24, 2025. The rally positions CC among the strongest gainers in a market environment characterized by heightened volatility and institutional interest in privacy-centric blockchain solutions.

Institutional Backing Drives Network Credibility

The Canton network has attracted substantial attention from traditional financial institutions seeking privacy-focused infrastructure for large-scale asset onboarding. The blockchain operates with over 600 validators, including 33 super nodes managed by institutional participants. This validation structure provides a level of security and decentralization that appeals to entities handling sensitive financial operations.

Notable institutions supporting the Canton ecosystem include Goldman Sachs Group, BNP Paribas, Circle Ventures, Liberty City Ventures, and Citadel Securities. This backing from established financial players lends credibility to the network’s technical architecture and long-term viability. The involvement of such institutions signals growing recognition of blockchain privacy solutions within traditional finance circles.

The network’s monolithic security approach differentiates it from other privacy protocols. This architecture allows institutions to maintain compliance requirements while leveraging blockchain infrastructure for sensitive transactions. The combination of institutional participation and privacy features positions Canton as a bridge between traditional finance and decentralized systems.

Exchange Listings Boost Trading Activity

Recent listings on major cryptocurrency exchanges contributed significantly to CC’s price momentum. Over the past 24 hours, Bybit recorded nearly $220 million in CC spot trading volume, while MEXC exchange processed approximately $119 million. These volume figures demonstrate substantial market interest and liquidity depth.

The exchange listings expand accessibility for both retail and institutional traders. Higher liquidity reduces slippage for larger transactions, making the asset more attractive for position building. The concentration of volume on established platforms also indicates market confidence in CC’s legitimacy and growth potential.

Trading activity surged 334% in the past day, bringing total volume to approximately $360 million at the time of analysis. This dramatic increase suggests renewed interest from traders capitalizing on the privacy narrative gaining traction across the cryptocurrency sector.

Privacy Tokens Benefit from Regulatory Climate

Canton’s rally aligns with broader momentum in privacy-focused cryptocurrencies. Growing regulatory scrutiny of individual privacy across major jurisdictions has paradoxically increased demand for privacy-preserving blockchain solutions. Users and institutions seeking confidential transaction capabilities have turned to networks offering robust privacy features.

The current market environment reflects tension between regulatory frameworks and individual privacy rights. As governments implement stricter monitoring requirements, demand for privacy-centric technologies has intensified. This dynamic creates opportunities for projects like Canton that balance privacy with institutional-grade security.

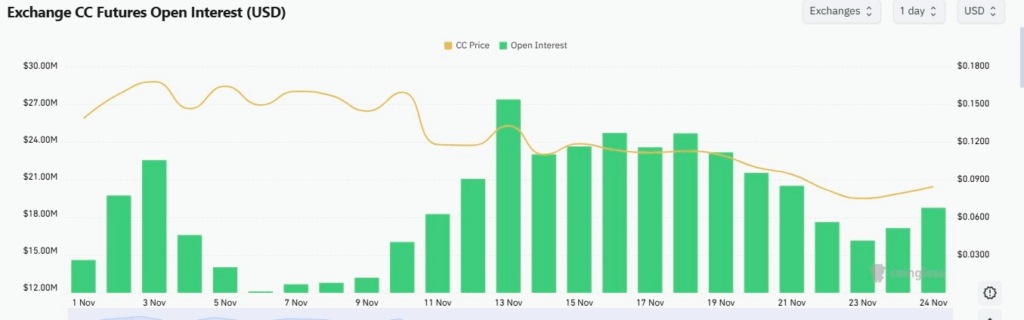

Market data from CoinGlass shows Canton Futures Open Interest (OI) climbing steadily in recent days, reaching approximately $19 million. Rising OI typically indicates growing trader conviction and sustained interest in an asset. The metric suggests participants are establishing positions in anticipation of continued price movement.

Market Sentiment Remains Cautious

Despite CC’s strong performance, broader market sentiment indicators show significant caution. CoinMarketCap’s Fear and Greed Index dropped below 15 out of 100 on Monday, marking extreme fear territory. The index reached its lowest level of 2025 last week, reflecting widespread uncertainty among cryptocurrency market participants.

This disconnect between CC’s rally and overall market fear suggests selective capital rotation rather than broad-based enthusiasm. Traders appear to be concentrating positions in specific narratives like privacy while remaining defensive about general market conditions. The extreme fear reading historically precedes either capitulation or contrarian buying opportunities.

Canton’s price rebound occurs during a critical phase of the 2025 cryptocurrency market cycle. The altcoin’s performance demonstrates that strong fundamentals and institutional backing can drive gains even when broader sentiment remains pessimistic. However, the prevailing fear suggests traders should approach with measured expectations and risk management protocols.

Comments are closed.