Featured News Headlines

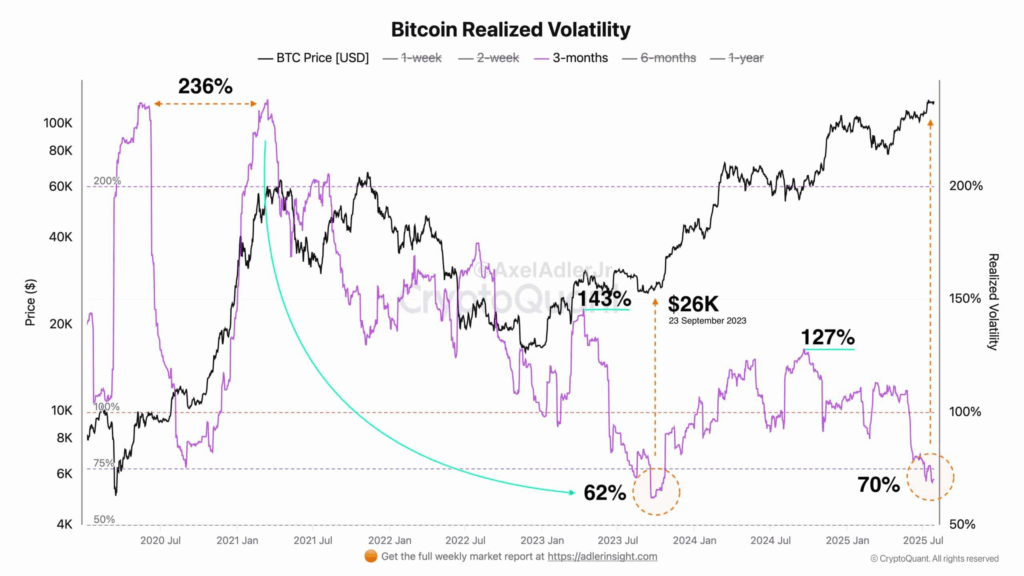

BTC Price- Volatility Sinks to 2023 Lows Amid Cooling Market

BTC Price– Bitcoin’s quarterly Realized Volatility has dropped sharply to 70%, nearing lows last seen in September 2023, when BTC hit $26,000. This signals the market is entering a calm consolidation phase—often the quiet before a major price move.

But don’t expect wild swings like in 2021. This cycle’s peak volatility was 143%, much lower than the 236% seen back then, hinting at a more measured market this time around.

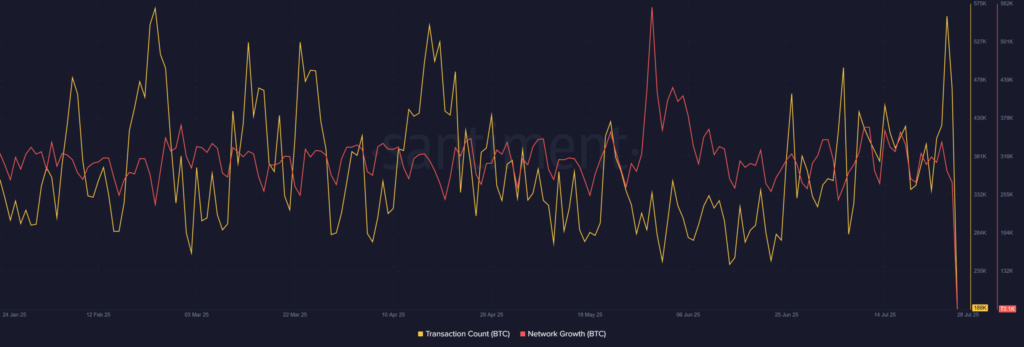

On-Chain Activity Fading Amid Price Stability

Bitcoin currently trades around $118,922 with only a slight daily gain, yet on-chain metrics tell a different story. Transaction counts have plummeted to 188,000, and network growth dropped to 72,100—both multi-week lows.

This decline reflects less user activity and fewer new wallets, classic signs of a market cooling off. While normal during sideways moves, if this trend continues, it could mean waning interest—unless a big macro catalyst sparks demand.

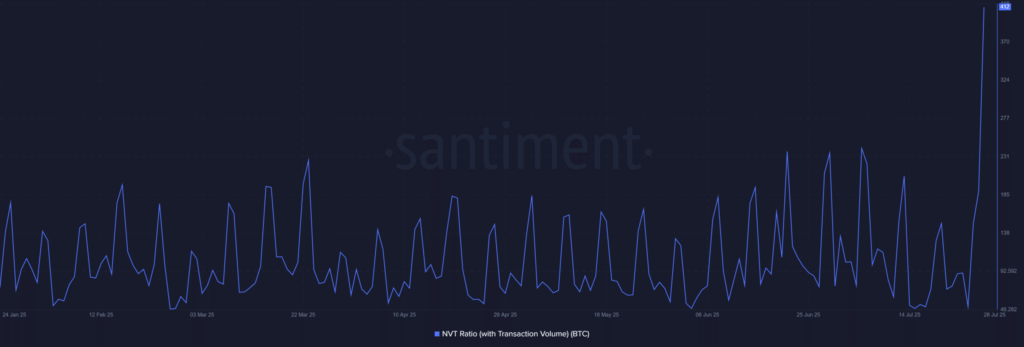

Signs of Overvaluation and Miner Pressure

The Network Value to Transactions (NVT) Ratio has surged to 412, signaling Bitcoin’s market cap is outpacing on-chain transaction volume—a red flag for potential overvaluation.

Meanwhile, miner revenue is shrinking. The Puell Multiple has dipped nearly 13% to 1.25, indicating tighter margins but no crisis yet.

Is Bitcoin Preparing for Its Next Breakout?

Despite fading activity and rising overvaluation signals, history shows that these quiet phases often precede explosive moves. If volatility stays low and fundamentals stabilize, Bitcoin may be quietly gearing up for its next big breakout.

Comments are closed.