Featured News Headlines

BlackRock Bitcoin ETF Returns 82% Since 2024

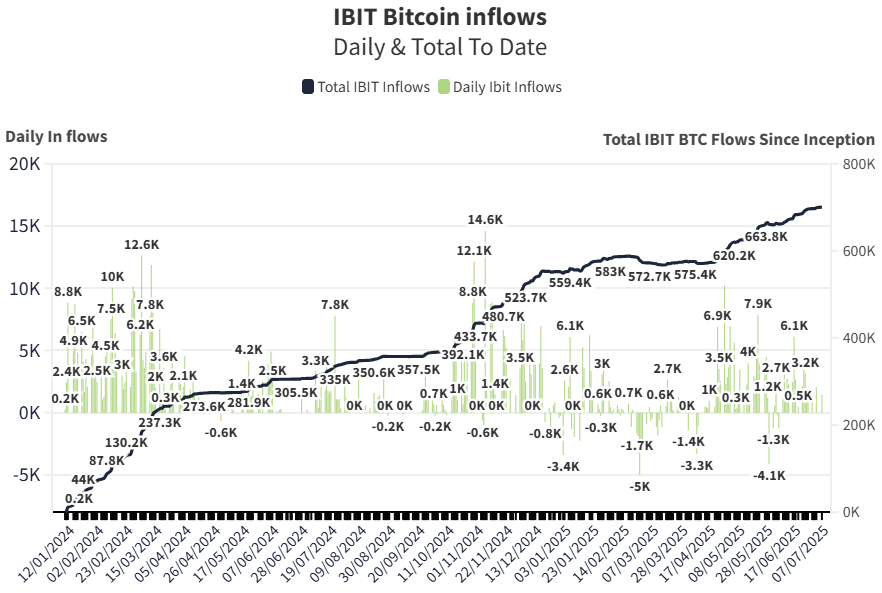

BlackRock Bitcoin ETF – BlackRock’s spot Bitcoin ETF, iShares Bitcoin Trust (IBIT), has crossed a major milestone by holding over 700,000 BTC, worth approximately $75.5 billion. On Monday alone, the ETF saw an additional $164.6 million inflow, further solidifying its position as the largest US spot Bitcoin ETF.

IBIT’s Massive Bitcoin Holdings and Growth

According to Apollo co-founder Thomas Fahrer, BlackRock now holds 700,307 BTC in its IBIT ETF. BlackRock’s own iShares website reported 698,919 BTC as of last Thursday, showing a steady increase of 1,388 BTC over two trading sessions. This impressive accumulation means IBIT controls more than 55% of all BTC held in US spot Bitcoin ETFs, per Bitbo data.

Since its launch in January 2024, the fund has delivered a remarkable total return of 82.67%, attracting massive investor interest.

Bitcoin Demand Outpacing Miner Supply

US Bitcoin ETFs and corporate giant Michael Saylor’s Strategy fund have collectively purchased more Bitcoin than miners have supplied almost every month in 2025. According to Galaxy Research, these entities bought Bitcoin worth $28.22 billion so far this year, while miners produced only $7.85 billion worth of new BTC.

Only in February did combined entities sell Bitcoin worth $842 million, making this a clear trend of institutional accumulation.

Regulatory Changes Could Speed Up Crypto ETF Approvals

The U.S. Securities and Exchange Commission (SEC) is reportedly moving toward a simplified approval process for crypto ETFs. The new structure would require issuers to file a Form S-1 and wait 75 days, after which ETFs can be listed if there are no SEC objections.

Recently, the REX-Osprey Solana and Staking ETF became the first US ETF offering investors exposure to staked crypto, combining SOL tokens with staking rewards.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.