Featured News Headlines

Bitcoin Whale Activity Climbs Despite Market Turbulence and Extreme Fear

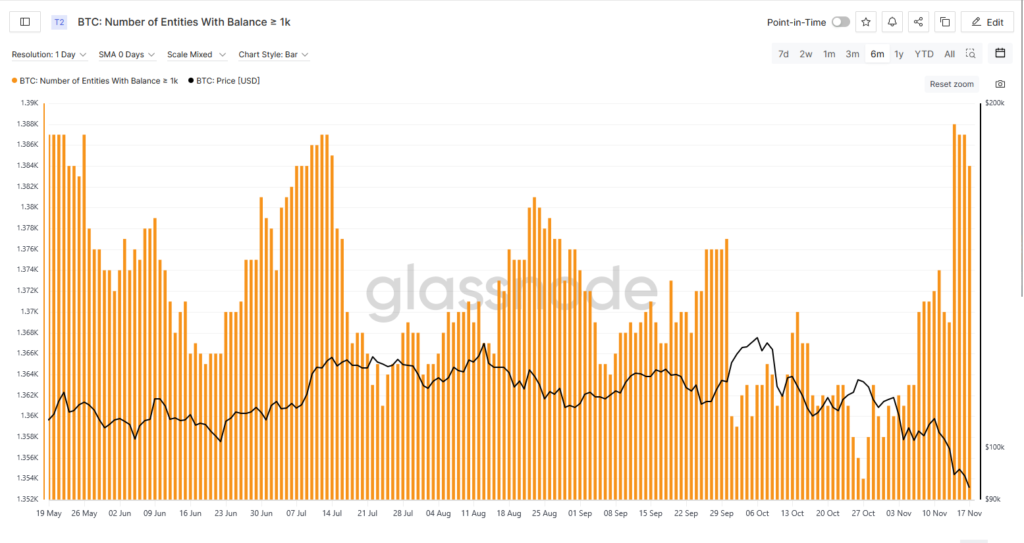

Bitcoin Whale Activity – The crypto market faced turbulence this week as Bitcoin (BTC) briefly dipped to $89,550 on Tuesday, sparking increased activity among whale investors. Data from Glassnode reveals a notable spike in the number of Bitcoin whale wallets, signaling heightened accumulation amid market pressure.

Whale Activity Intensifies Amid Price Drop

After hitting a yearly low of 1,354 whale wallets on October 27, when BTC traded around $114,000, the number of wallets holding 1,000 BTC or more climbed to 1,384 by Monday—a 2.2% increase, marking levels unseen in four months. Meanwhile, wallets holding 1 BTC or more have decreased from 980,577 on October 27 to 977,420 on November 17, challenging narratives about older investors “dumping” BTC to drive prices down.

Markus Thielen of 10X Research explained that some whale selling is still occurring, influenced heavily by the October 29 FOMC meeting from the US Federal Reserve. “Super-whales and mega-whales are absorbing some of the whale selling, but the 30-day net-flow ratio still shows decisive net selling,” Thielen noted.

Bitcoin Faces Extreme Fear

BTC trading below $90K pushed the Crypto Fear & Greed Index to 11/100, indicating extreme fear. Despite this, several executives see opportunity in the downturn. Matt Hougan, CIO of Bitwise Asset Management, called the current levels a “generational opportunity,” suggesting long-term investors could benefit as BTC nears a bottom.

Meanwhile, social media commentary reflects optimism as well. Gemini co-founder Cameron Winklevoss posted that this may be “the last time you’ll ever buy Bitcoin below $90K,” while analysts like TheCryptoDog predict BTC is due “for a bounce soon,” with support levels around $87,700 potentially triggering a recovery.

Market Implications

The divergence between whale accumulation and broader market caution highlights shifting dynamics. While retail investors remain hesitant, mega-whales are strategically absorbing supply, potentially setting the stage for BTC’s next rally despite ongoing macroeconomic uncertainty.

Comments are closed.