Bitcoin Whale Activity Rises- BTC Surpasses $109K, But Is the Rally Sustainable?

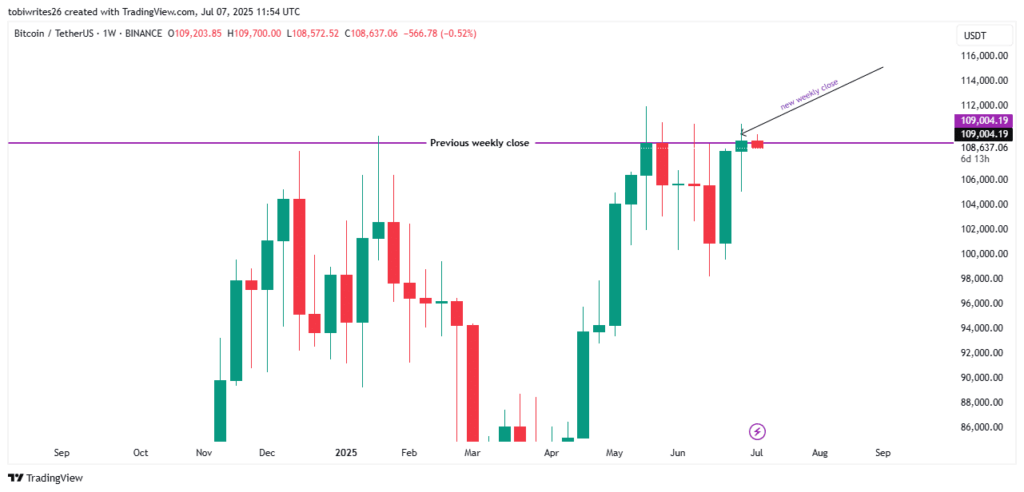

Bitcoin Whale Activity Rises– On July 6th, Bitcoin [BTC] locked in its first-ever weekly close above $109,000, ending at $109,216 and edging past the previous high of $109,004. This key breakout shifted market sentiment, flipping many sellers into buyers. However, traders remain cautious, awaiting confirmation of a sustained move.

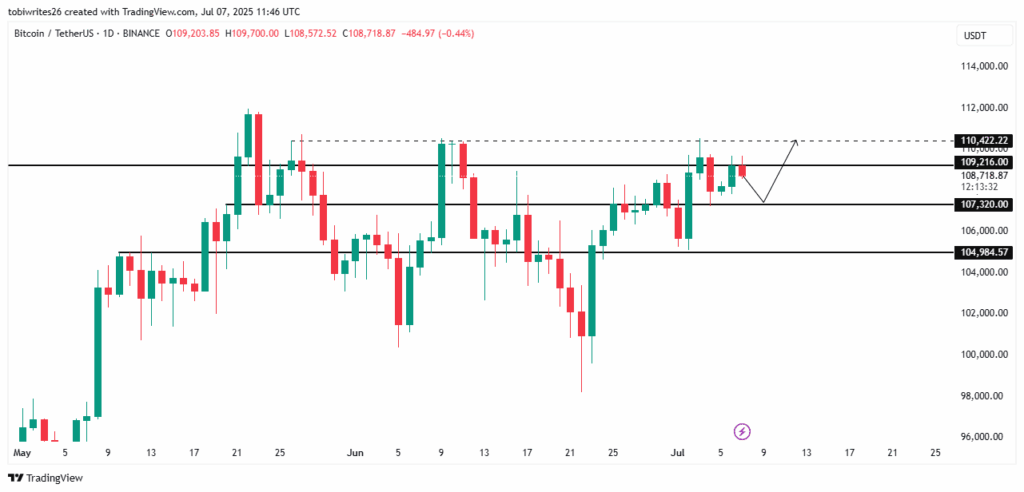

Bitcoin [BTC] is now eyeing a potential dip toward the $107,320 support. If this level holds, bulls may push for the $110K zone. But a breakdown could send prices toward the next critical support near $104,984.

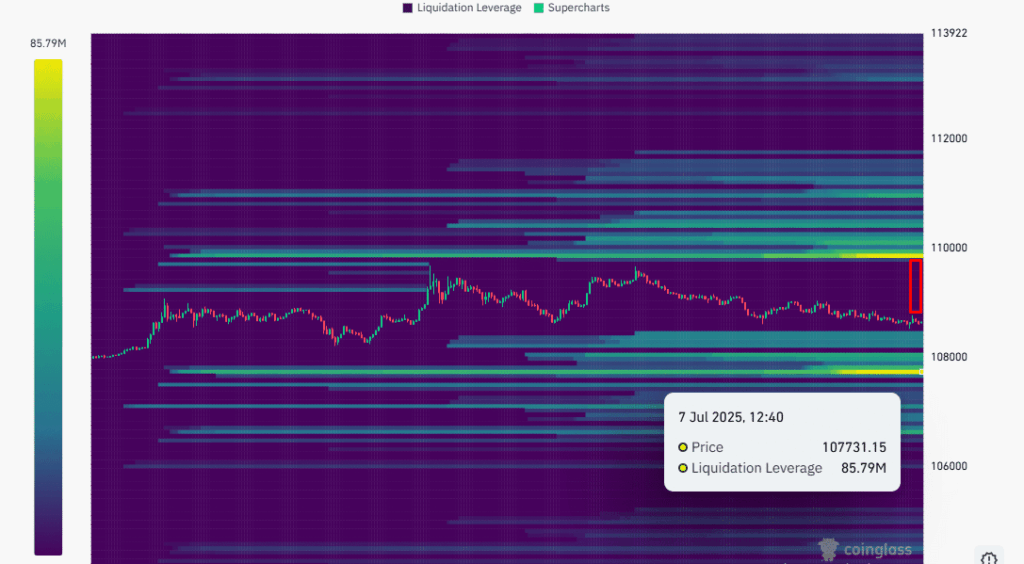

According to Binance’s Liquidation Heatmap, a notable cluster of liquidity sits at $107,731.15, where leveraged positions total $85 million. Between Bitcoin’s current price and $110K, liquidation levels are minimal—suggesting a possible short-term drop to trigger liquidity before any major upward move.

Long-Term Confidence Strengthens

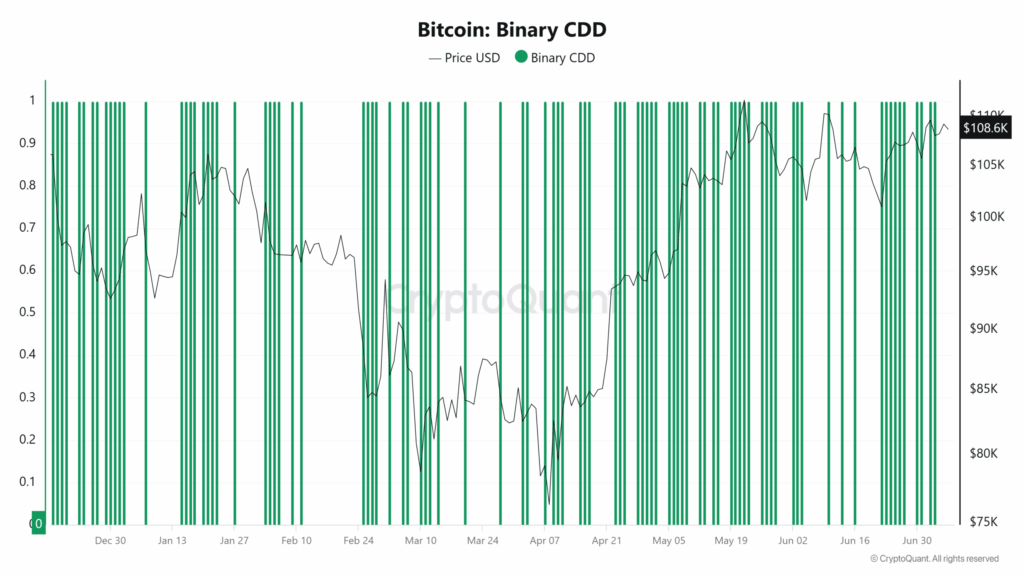

Macro FUD is fading fast. On July 7th, CryptoQuant’s Binary Coin Days Destroyed (CDD) indicator showed a significant decline, indicating long-term holders are choosing to hold rather than sell. “This signals that large BTC holders have resumed accumulation,” noted analysts.

CoinGlass data also supports this view. After a short sell-off on July 1st, institutions quickly bought back over $1 billion in Bitcoin [BTC], reinforcing bullish conviction.

Profit-Taking Slows, Whales Re-Enter

CryptoQuant’s Net Realized Profit plunged from $9.08B to $315M in just three days. Exchange Depositing Addresses dropped to 22,000—levels unseen since 2016. This shift toward self-custody reflects rising investor confidence.

Meanwhile, whales holding 10K–100K Bitcoin [BTC] resumed accumulation in both March and July. Despite high profitability, these large players didn’t sell—they waited.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.