Featured News Headlines

Bitcoin Under Pressure- ETF Flows Tank as Bitcoin Stalls Near Highs

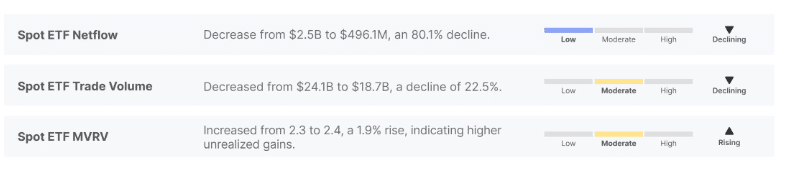

Bitcoin Under Pressure– Bitcoin [BTC] had a quiet week, but under the surface, signals are starting to flash. According to Glassnode, ETF inflows dropped by 80% — the sharpest decline in months. That’s a big red flag, especially with institutional money stepping back, at least for now.

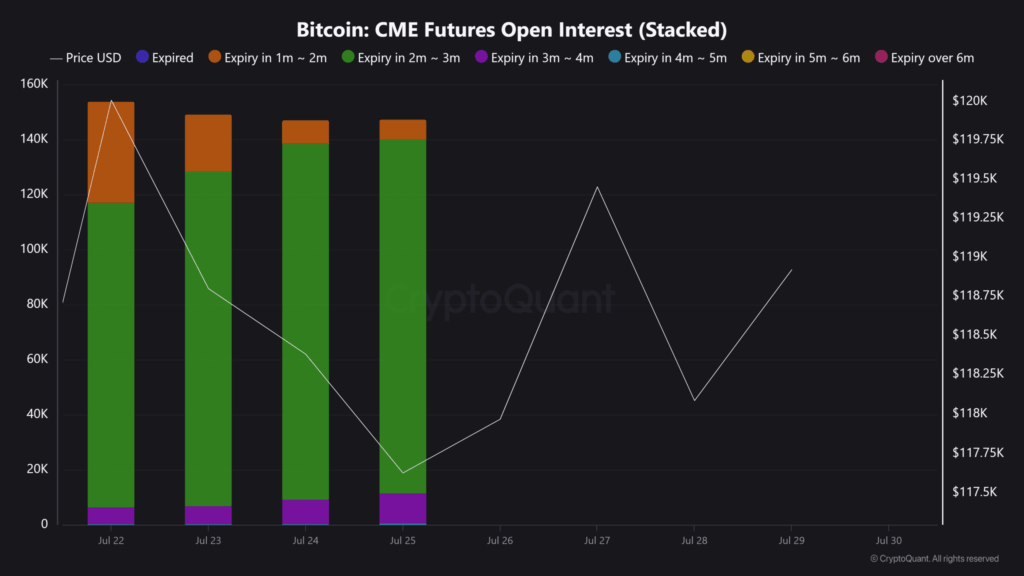

Derivatives Still Heating Up

Despite the ETF cooldown, derivatives markets remain active. CryptoQuant data shows CME Futures Open Interestis still high — a sign that short-term traders are betting on a continuation of the rally. This divergence highlights growing uncertainty: spot buyers are pausing, but speculators are still all-in.

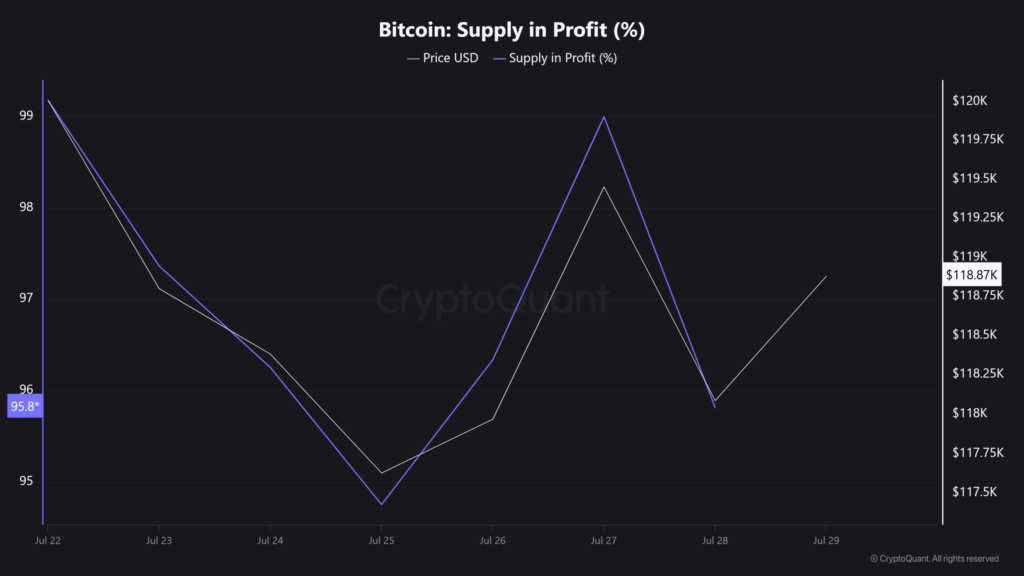

Profit-Taking Risks Are Rising

Here’s where it gets tricky. On-chain data reveals that 95.8% of all BTC supply is in profit. While that’s a bullish long-term signal, it also means most holders are in the green — and could be tempted to lock in gains if momentum fades.

That sets the stage for potential short-term corrections, especially if confidence among weak hands crumbles.

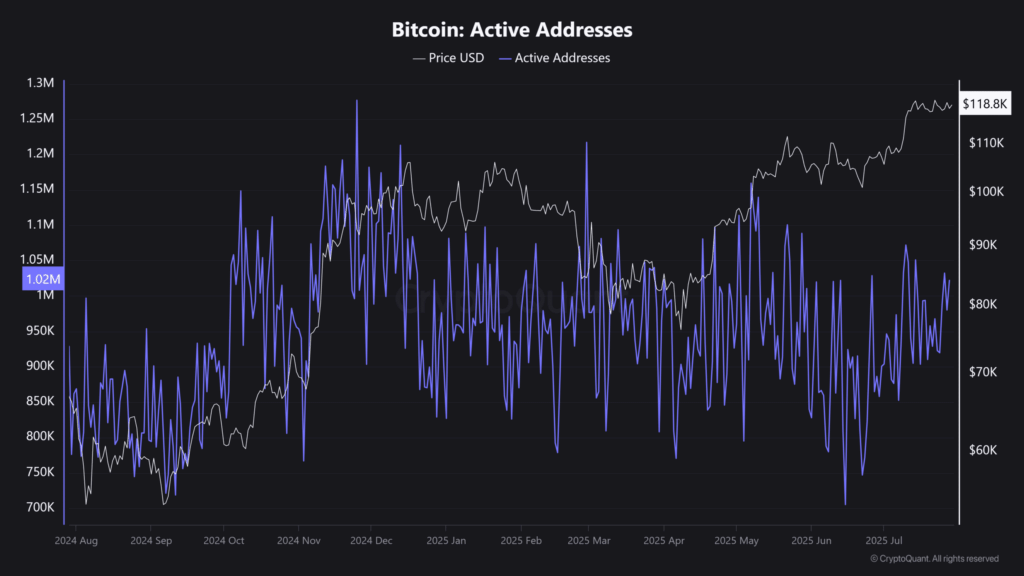

Fading Activity Signals Caution

Another red flag? Active Bitcoin addresses have declined from early July highs. That suggests big players are in wait-and-see mode. No panic selling — but no strong buying either. It’s a market in limbo.

What’s Next for BTC?

Bitcoin is currently in a holding pattern. Institutional inflows have cooled, retail isn’t stepping up yet, and speculative bets are keeping the market afloat.

The key question now: Will new demand kick in before profit-taking triggers a sell-off?

Until then, traders should stay alert — because when nearly everyone is in profit, volatility tends to follow.

Comments are closed.