Featured News Headlines

Crypto Markets Slide: BTC Drops to $115K as Geopolitical Tensions Rise

After a relatively steady weekend, where Bitcoin hovered around $117,500, a sharp movement occurred Monday morning: the price dipped to $115,000, marking an 11‑day low. Meanwhile, the broader altcoin market followed suit, as investors awaited renewed developments on a potential peace agreement between Ukraine and Russia.

A Rollercoaster Week for BTC

The week had begun on a hopeful note. Bitcoin climbed from $118,000 to exceed $122,000 on Monday. Despite a pullback on Tuesday, momentum returned midweek—especially Thursday—when BTC surged to a then all‑time high above $124,500.

Yet, that spike was brief. Shortly after, Bitcoin retreated to $121,000, then slipped further to $118,000, reacting to hotter‑than‑anticipated U.S. Producer Price Index (PPI) data for July.

Headlines and Markets: The Peace Talks Connection

During the back half of the week, headlines emerged that could’ve shaken markets: a meeting between Donald Trump and Vladimir Putin exploring a peace settlement between Russia and Ukraine.

Despite the news, Bitcoin held firm—trading sideways between $117,000 and $118,000 over the weekend. But Monday morning brought a notable shift. BTC slipped to $115,000, a fresh 11‑day low, as attention turned toward a new meeting between Trump and Ukraine’s President Zelenskyy.

While Bitcoin has so far defended that level, it remains more than 2% lower on the day.

Market Cap and BTC Dominance: What’s Changing?

Bitcoin’s market capitalization now stands near $2.3 trillion, while its dominance over altcoins hovers around 58%, according to CoinGecko.

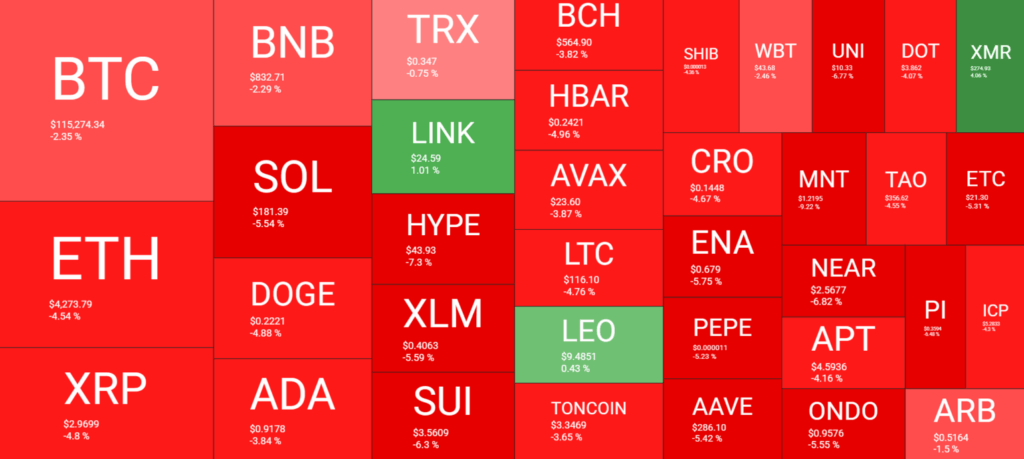

Altcoins in Decline—With Few Standing Out

The broader crypto landscape is following Bitcoin’s lead. Notable altcoins are down significantly:

- Ethereum (ETH) slipped below $4,300, down about 4.5% in 24 hours.

- XRP also broke below the $3.00 support level after a similar drop.

- Others—including SOL, HYPE, XLM, SUI, ENA, PEPE, AAVE, MNT, NEAR, and ONDO—have posted even steeper declines.

A handful of coins—Chainlink (LINK) and Monero (XMR)—stand out, showing modest gains over the past day.

All told, the total crypto market cap has lost over $100 billion in 24 hours, now sitting approximately at $3.96 trillion.

Understanding the broader implications behind Bitcoin’s price movements is essential—not just for BTC holders, but for anyone involved in the crypto space. Price volatility, macroeconomic data, geopolitical developments, and market dominance indicators all play a role in shaping short- and long-term trends.

Short-Term Price Movements:

A sharp drop in Bitcoin’s price rarely happens in isolation. As the largest and most influential cryptocurrency, Bitcoin often sets the tone for the entire market. When BTC begins to fall, investor sentiment across the board tends to shift toward caution, leading to widespread sell-offs in altcoins. This domino effect can trigger significant volatility, with altcoins sometimes experiencing even deeper corrections due to their generally higher risk and lower liquidity.

Macroeconomic Factors:

Key economic indicators—such as the U.S. Producer Price Index (PPI)—have a growing influence on crypto markets. Rising PPI numbers usually point to increasing inflation pressures, which can lead central banks to consider interest rate hikes. In response, investors often pull back from risk-on assets like cryptocurrencies. As inflation expectations rise, the appeal of speculative markets like crypto tends to decrease, leading to price corrections across both Bitcoin and altcoins.

Geopolitical Events:

Global political developments, particularly involving major world powers, can create uncertainty—or, in some cases, optimism—in financial markets. Ongoing peace negotiations between leaders like Donald Trump, Vladimir Putin, and Volodymyr Zelenskyy have a direct psychological effect on investor behavior. Positive signals from such meetings might encourage market stability or even short-term rallies. However, failed talks or increased tension can just as easily spark fear and drive markets downward.

Comments are closed.