New Trump Tariffs Impact Crypto: Bitcoin Dips Below Key Level

Following the issuing of an executive order by US President Donald Trump to impose import taxes on goods from China, Canada, and Mexico, Bitcoin has fallen below $100,000 for the first time in six days.

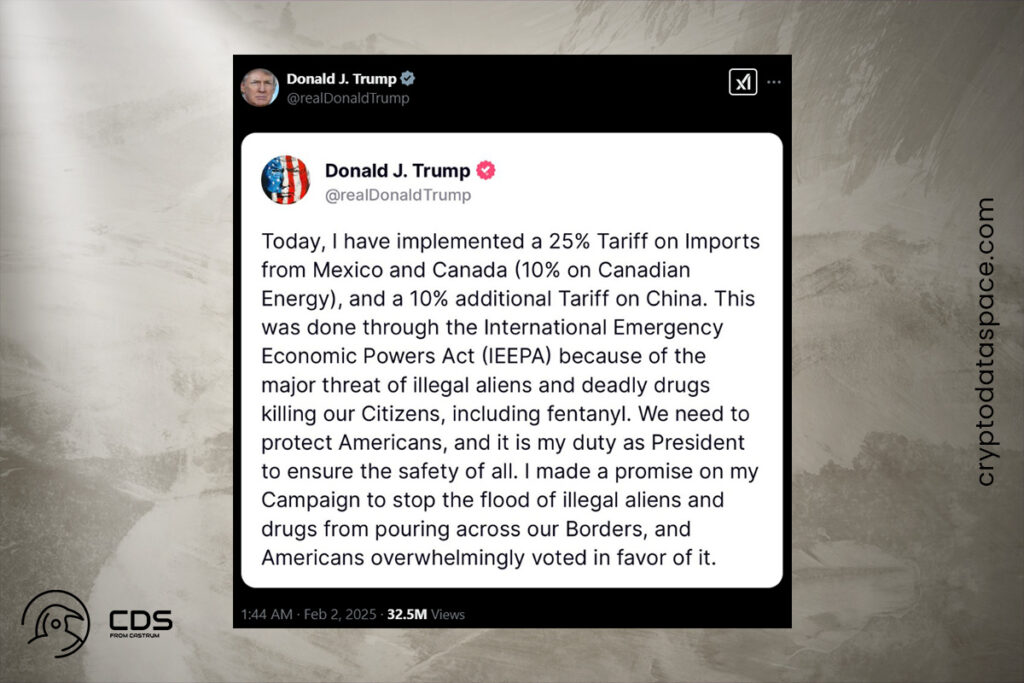

Trump is implementing a 25% additional tariff on imports from Canada and Mexico and a 10% additional tariff on imports from China. Energy resources from Canada will have a lower 10% tariff. Trump is taking bold action to hold Mexico, Canada, and China accountable to their promises of halting illegal immigration and stopping poisonous fentanyl and other drugs from flowing into our country.

White House’s statement

Bitcoin Falls Below $100K as Canada, China, and Mexico Retaliate Against U.S. Tariffs

The three nations have already retaliated against the imposed tariffs, and opinions inside the cryptocurrency business regarding the impact on the wider market are mixed. In a news conference shortly after Trump’s announcement, Canadian Prime Minister Justin Trudeau declared that he would levy a 25% tariff on $106.5 billion worth of US imports. According to reports, China’s Ministry of Commerce announced that it will file a complaint with the World Trade Organization (WTO) and take appropriate action in response.

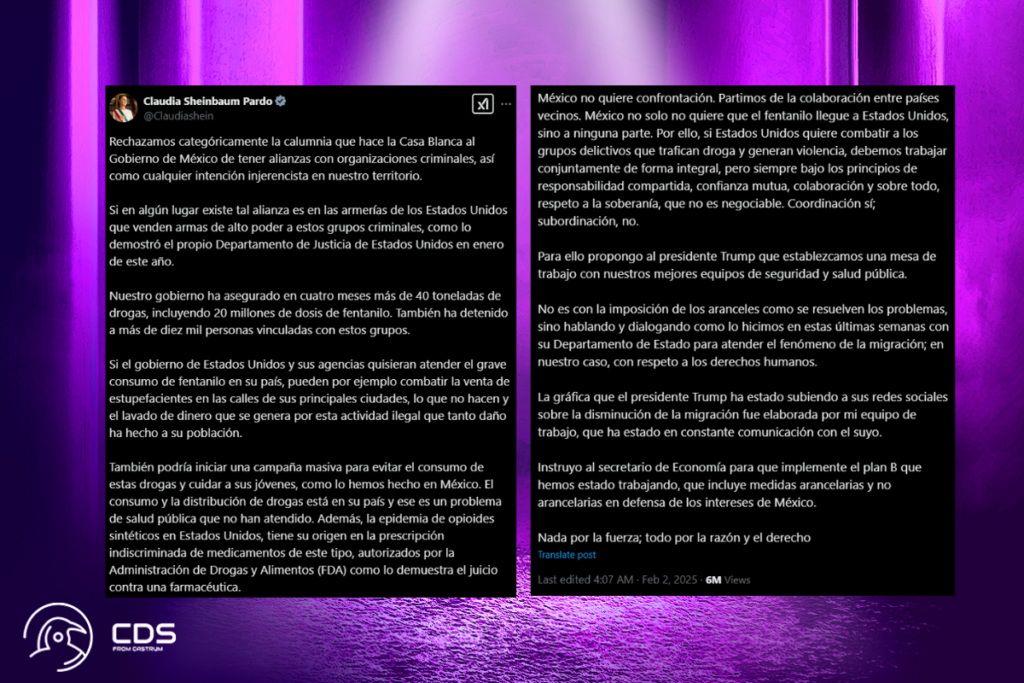

The Mexican president, Claudia Sheinbaum, stated in a long X post that she has directed the secretary of economy to carry out plan B, which consists of tariff and non-tariff measures to protect Mexico’s interests. Bitcoin fell to $99,111 after the retaliations, breaking below the psychological $100,000 price threshold for the first time since January 27.

Trump Tariffs Spark Crypto Debate: Bull Cycle Over or Just a Market Dip?

Regarding the extent to which the imposed tariffs would affect the larger crypto market, the crypto industry is divided. The founder of Crypto Capital Venture, Dan Gambardello, does not agree with the narrative.

I cannot believe there’s a popular opinion floating around that Trump tariffs and his memecoins ended the bull cycle. BlackRock is continuing to accumulate ETH and BTC while retail frantically panics because crypto is currently consolidating,

Gambardello

Bitcoin is not sufficiently isolated from the international markets and trades like triple-levered tech these days, according to one opponent, Adam Cochran, a partner with Cinnaeamhain Ventures.

An economic squeeze of this scale just means pain all around, and we should be ok with denouncing that,

Cochran

For more up-to-date crypto news, you can follow Crypto Data Space.

2 Comments