Bitcoin Rally Pausing: Why Consolidation May Be Bullish Long-Term

Following its recent surge to new all-time highs, Bitcoin may be about to enter a brief period of consolidation. But according to Michael Harvey, head of franchise trading at Galaxy Digital, getting another jump up before the end of July isn’t out of the question.

Consolidation around current prices is my base case given the large rally and new ATH. I do expect BTC to trend higher into the year-end, but pausing here for air would be realistic. I think the best case BTC price into month end is a continued slow melt-up.

Harvey

Bitcoin Eyes New Heights, But Is Retail Demand Still Missing?

Getting to new heights by the end of this month is the best-case scenario, he said. Nevertheless, he noted that this would necessitate a vigorous rise in retail demand, sustained robust inflows into US-based spot Bitcoin ETFs, and ongoing Bitcoin treasury company accumulation.

Despite recent robust inflows into spot Bitcoin ETFs and increasing demand from Bitcoin treasury firms, the industry is still debating whether retail demand has yet to materialize. The recent surge in Coinbase’s ranking to No. 137 on the US Apple App Store suggests that retail interest may be increasing. On the other hand, the low volume of Google searches for “Bitcoin” indicates that there is still no indication of widespread retail demand.

Harvey Warns: Bitcoin Could See Sharp Pullback Amid Profit Taking

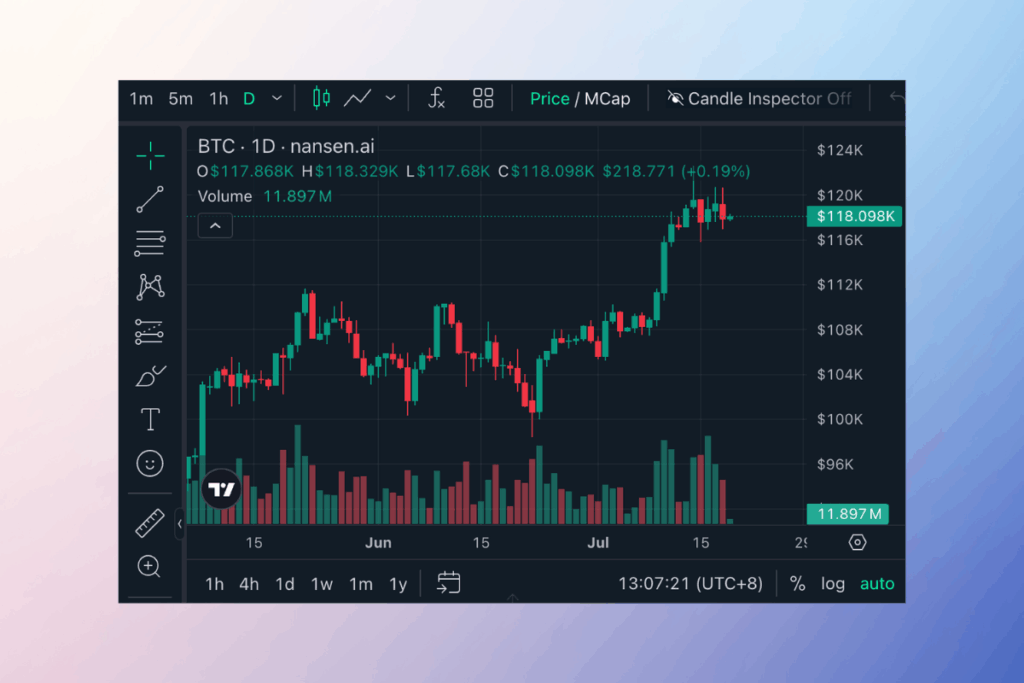

Nansen data shows that Bitcoin hit a new all-time high of $122,884 on Monday but then dropped back to $118,303 at the time of writing. The price of Bitcoin might go back below $110,000 in the near future, according to Harvey’s worst-case scenario.

Bear case is a risk-off move driven by profit taking and/or equity market weakness, which I believe could see BTC retrace 5-10%,

Harvey

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.