Featured News Headlines

Bitcoin Price – Spot Bitcoin ETFs Fuel Bitcoin’s Rally

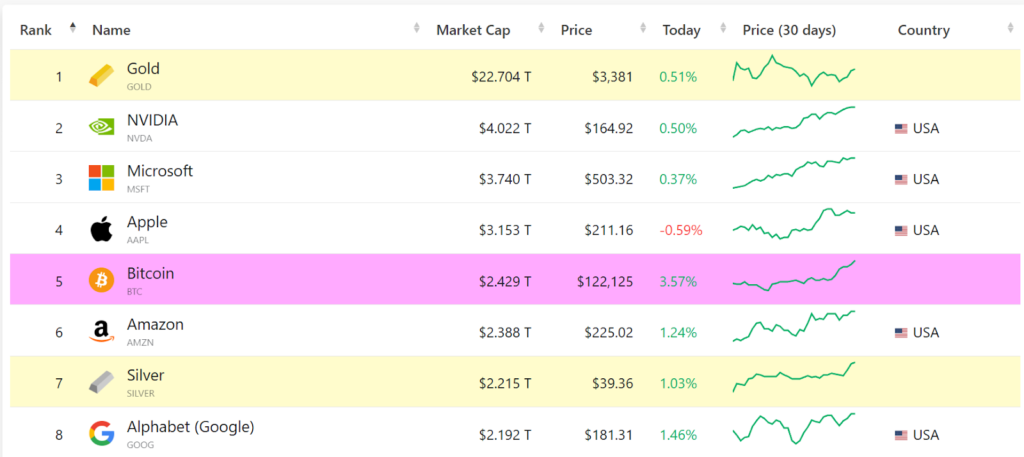

Bitcoin Price – Bitcoin (BTC) recently surged to a new all-time high of $122,600, marking a nearly 13% gain over the past week, according to Cointelegraph. This remarkable rally propelled Bitcoin’s market capitalization beyond $2.4 trillion, surpassing major giants such as Amazon ($2.3 trillion), Silver ($2.2 trillion), and Alphabet (Google) at $2.19 trillion.

With this momentum, Bitcoin edged closer to tech titan Apple, trailing by just $730 billion. Market analyst Enmanuel Cardozo from the asset tokenization platform Brickken emphasized that the growing institutional adoption, led by firms like BlackRock and MicroStrategy, has cemented Bitcoin’s place as a legitimate investable asset. He highlighted that continued regulatory progress and a supportive macro environment could soon push Bitcoin’s market cap past Apple’s valuation, implying a price above $142,000.

Eyes Set on Microsoft: Could Bitcoin Reach $167,000?

Cardozo also pointed out that investors are eyeing an even bigger milestone: overtaking Microsoft’s market cap. Such a breakthrough would mean Bitcoin climbing to around $167,000, a scenario he describes as “not outside the realm of possibility,” especially given the soaring demand fueled by spot Bitcoin ETFs.

Institutional Demand Fuels Bitcoin’s Record Rally

The surge coincides with accelerating institutional adoption. Since June, the number of companies holding Bitcoin has more than doubled to over 265 firms. Together, corporate treasuries hold around 3.5 million BTC, with public companies holding 853,000 BTC (4% of supply) and spot ETFs controlling over 1.4 million BTC (6.6%).

Spot Bitcoin ETFs Boost Liquidity and Price Momentum

Spot Bitcoin ETFs have added significant liquidity with over $1 billion in net inflows last Friday alone, marking a seven-day consecutive buying streak. This influx has been a key driver behind Bitcoin’s price surge since early 2024. Additionally, the ongoing “Crypto Week” in the U.S., with lawmakers debating major cryptocurrency bills like the GENIUS Act, CLARITY Act, and the Anti-CBDC Surveillance State Act, is fueling excitement around the crypto industry’s future.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.