Featured News Headlines

Bitcoin Miners Face Profitability Challenges Amid Market Uncertainty

Bitcoin continues to trade well below its recent peak, leaving both investors and miners under increasing strain. The flagship cryptocurrency remains roughly 30% below its $126,000 high, pushing a significant portion of market participants into unrealized losses and raising questions about broader network stress.

Short-Term Holders Remain Underwater

Recent data shows that many short-term holders are still in negative territory. The short-term holder (STH) cost basis is estimated near $102,000, indicating that these participants are sitting on approximately 12% in unrealized losses. This dynamic has added to selling pressure during periods of heightened volatility, as confidence across the market remains fragile.

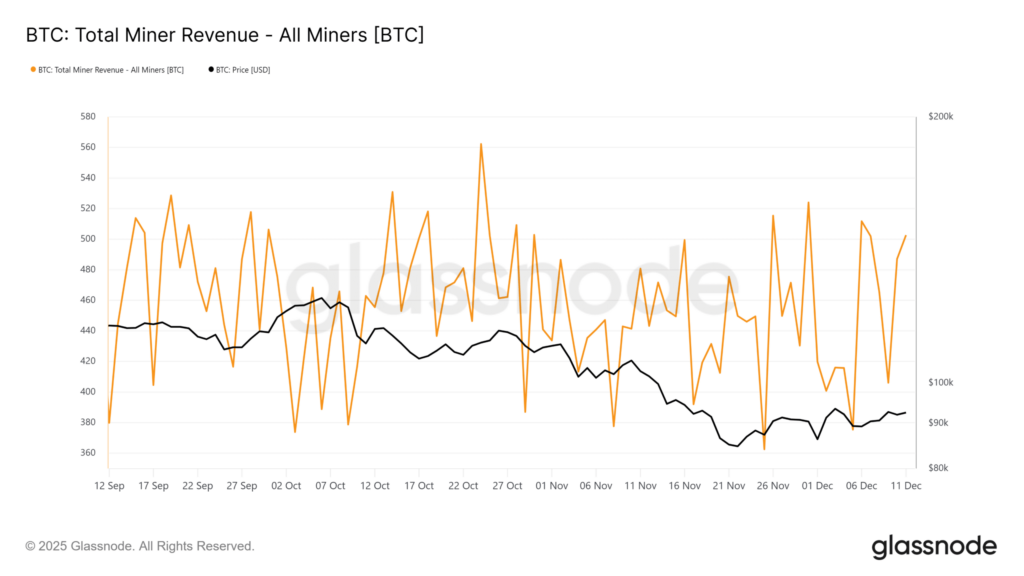

Miner Revenue Declines Despite Higher Difficulty

Conditions for Bitcoin miners have also deteriorated. According to blockchain analytics firm Glassnode, total daily miner revenue fell from around 562 BTC in mid-October to approximately 502 BTC currently—an 11% decline. This drop has occurred even as mining difficulty continues to climb.

In early November, Bitcoin mining difficulty surged to a new all-time high of 159 trillion. As a result, miners are required to deploy significantly more computational power and energy to earn the same block rewards, compressing margins and increasing operational costs.

“Miners are effectively working harder while earning less,”

analysts noted, pointing to a clear squeeze on profitability.

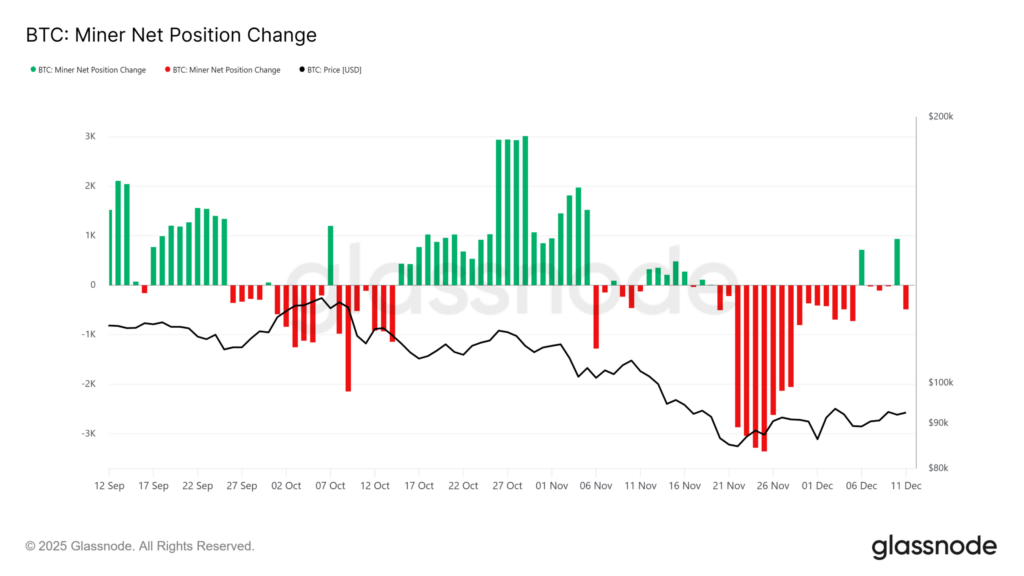

Signs of Potential Miner Distribution

Market uncertainty has compounded the pressure. Bitcoin has yet to fully enter a risk-on phase, with the $90,000 price level showing limited stability. Meanwhile, institutional participation remains inconsistent, as Bitcoin ETF flows continue to fluctuate sharply. The most recent figures showed net outflows of roughly $80 million.

On-chain data also suggests renewed stress among miners. In late November, miners recorded a net position change of –3,555 BTC, coinciding with a drop in Bitcoin’s price toward $80,000. More recently, the metric has again turned negative, registering net outflows of around –487 BTC.

Comments are closed.