Featured News Headlines

DAT Stocks Face Sharp November Sell-Off

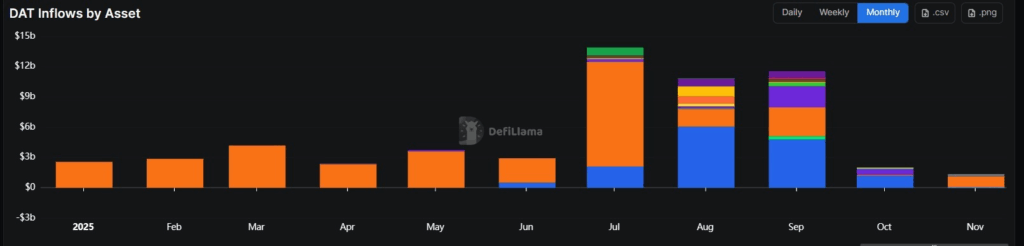

Digital asset treasuries (DATs) experienced a notable slowdown in November, marking the weakest inflows of 2025 as the corporate treasury boom eased. According to data aggregator DefiLlama, November brought only $1.32 billion in DAT inflows, the sector’s lowest monthly figure this year. This represents a 34% drop from October’s $1.99 billion and an 88% decline from the record $11.55 billion seen in September.

Bitcoin Leads Inflows

Bitcoin DATs accounted for the majority of November inflows, totaling $1.06 billion. DefiLlama data highlighted two major purchases that drove this surge: Strategy’s $835 million Bitcoin acquisition on November 17 and Metaplanet’s $130 million purchase on November 25. XRP followed with $214 million in inflows, while Ether, which led DAT inflows over the previous three months, saw outflows of around $37 million despite continued accumulation by BitMine Immersion Technologies.

DAT Equities Face November Sell-Off

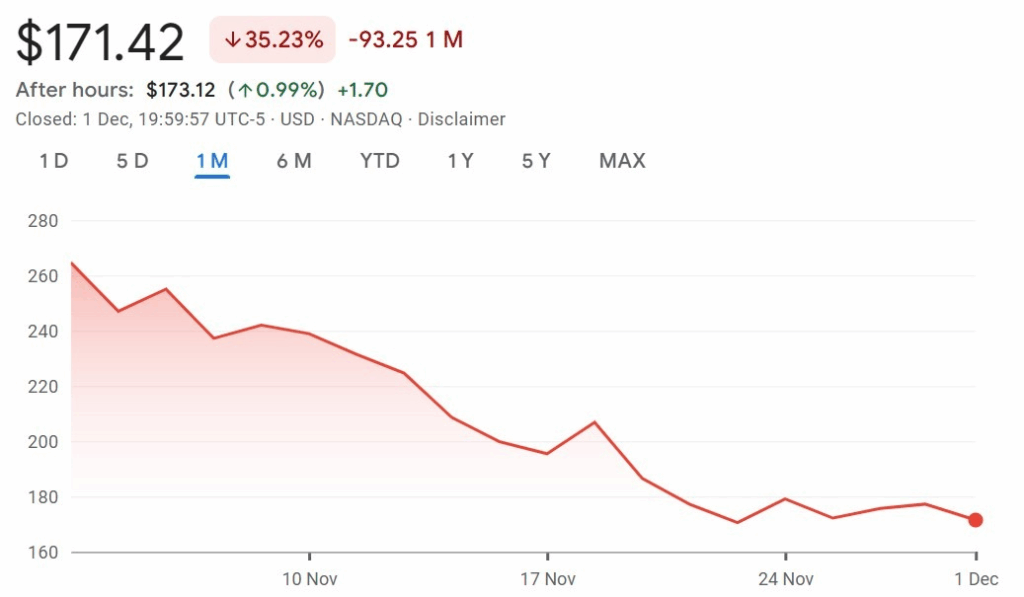

The slowdown in inflows was accompanied by a sharp correction in DAT equities. Major DAT stocks underperformed throughout November, despite a brief rally on the first Monday of the month. Strategy, the sector’s largest DAT, fell 35.23% over the month, dropping from $264.67 on November 3 to $171.42 at the time of reporting.

Despite the decline, Strategy chairman Michael Saylor remained resolute on social media, stating he “won’t back down” from the company’s Bitcoin position. Meanwhile, Japanese Bitcoin accumulator Metaplanet slid 20.67%, falling from 450 Japanese yen ($2.89) to $2.29.

Ether-focused DATs also experienced substantial losses. BitMine’s stock dropped from $42.86 to $28.94, a 32.48% decline, while Sharplink Gaming fell 26.66%, going from $13.09 to $9.60 over the same period.

Solana Holdings Suffer Largest Losses

Among all major DATs, Forward Industries, the largest corporate holder of Solana tokens, recorded the steepest percentage decline. According to Strategic Solana Reserve data, the company’s stock fell 43% in November, dropping from $13.91 to $7.86. CoinGecko data further revealed that Forward Industries is carrying unrealized losses of $712.52 million from its Solana acquisitions.

Market Differentiation on the Horizon

DATs have traditionally moved in tandem, rising and falling together, a trend highlighted by Bitwise chief investment officer Matt Hougan. “The last six months showed that DATs tend to move in lockstep, rising and falling together,” Hougan said.

However, Hougan expects this phase of uniformity to end. He predicts the market will increasingly differentiate between companies based on strategic coherence and execution. DATs that demonstrate clear strategies and effective management may gain recognition, while those that fail to execute efficiently could face continued pressure.

Sector Dynamics

The November slowdown reflects broader market dynamics as investors reassess risk and liquidity in the digital asset sector. The sharp correction in DAT equities underscores the volatility inherent in digital asset corporate treasuries. Companies heavily invested in single assets, such as Bitcoin, Ether, or Solana, were particularly affected by market movements during the month.

DATs have become an important tool for corporate treasury management, offering exposure to digital assets alongside traditional balance sheet holdings. Yet, the sector’s volatility remains evident, as shown by the dramatic declines in stock prices and market value for some of the largest players.

The sector may enter a period of greater differentiation, as Hougan noted, with market participants rewarding firms that exhibit strategic discipline and operational clarity. Investors and industry observers are closely watching which companies can sustain growth and maintain liquidity amid volatile market conditions.

While November was a challenging month, the DAT landscape continues to evolve rapidly, with Bitcoin leading inflows, Ether facing headwinds, and Solana holdings experiencing notable losses. The sector’s future will likely hinge on the ability of companies to balance asset accumulation with strategic execution.

Comments are closed.