Featured News Headlines

Bitcoin Pauses as $120K Short Squeeze Looms

Bitcoin [BTC] is pausing after weeks of intense action, but signs suggest the calm may not last long. With a historic milestone reached and billions in short positions at risk, the market’s next move could be decisive.

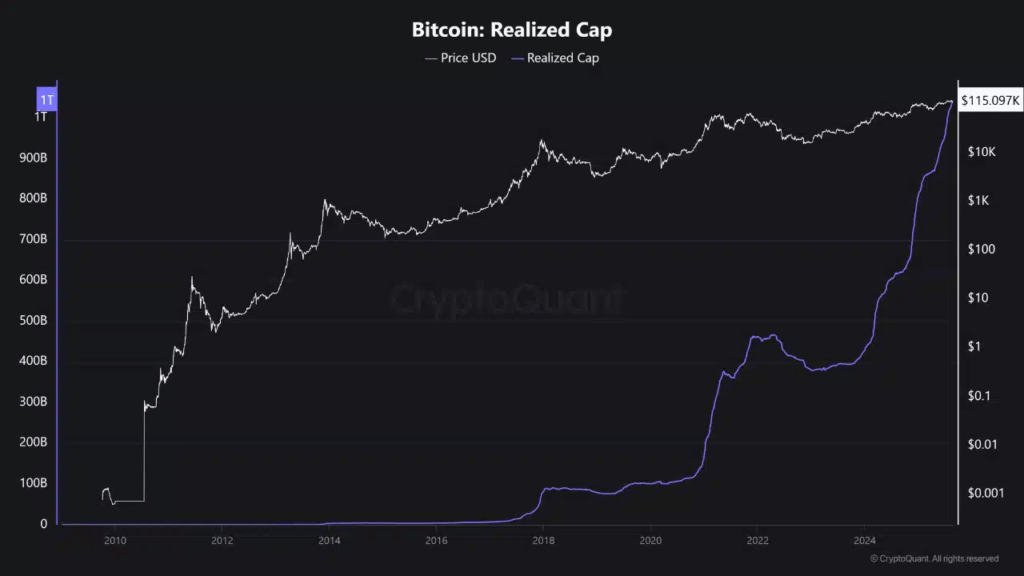

A Trillion-Dollar Milestone Beyond Price

Bitcoin’s realized capitalization has officially surpassed $1 trillion for the first time ever — a major indicator of the capital truly committed to the network.

Unlike market cap, which reflects price multiplied by supply, realized cap values each coin at its last transaction price, offering a clearer picture of actual investment inflows. This surge points to a rally driven by real buying, not just speculative hype.

“This marks a new phase of investor conviction — more BTC is being held at higher valuations,” noted one analyst.

If this momentum continues, a path toward a $2 trillion realized cap could reshape Bitcoin’s role in global finance.

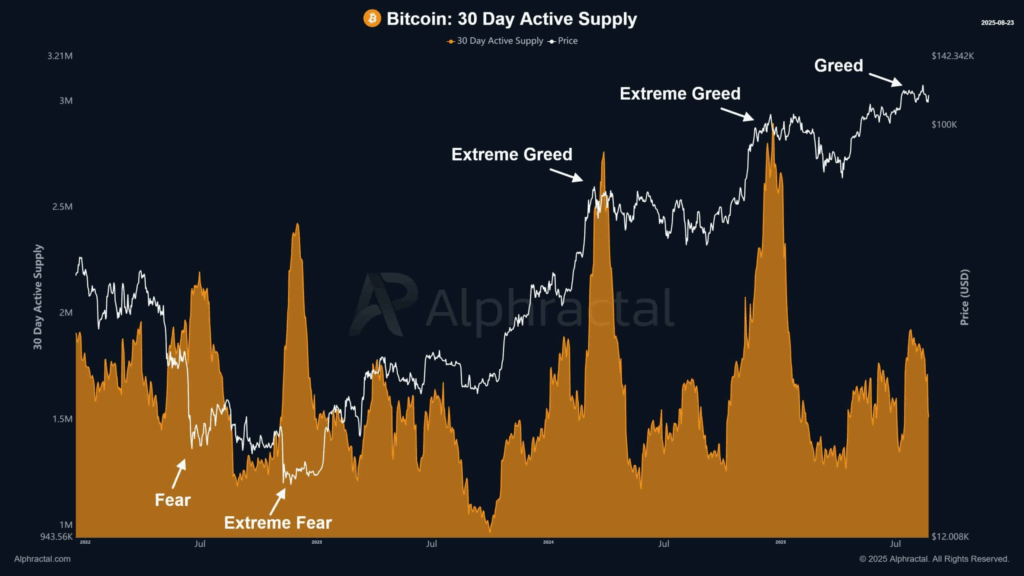

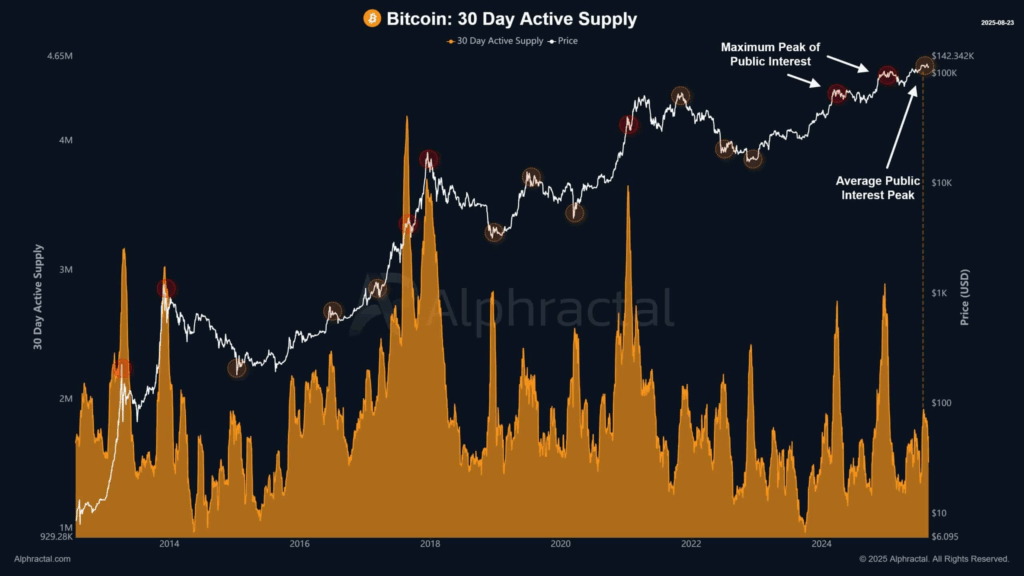

Market Activity Slows — For Now

Bitcoin’s 30-day active supply has declined, signaling a drop in coin movement. Historically, such cooldowns have acted as precursors to sharp volatility, allowing the market to reset before its next directional push.

While low activity suggests temporary calm, previous cycles show these periods often precede significant price shifts.

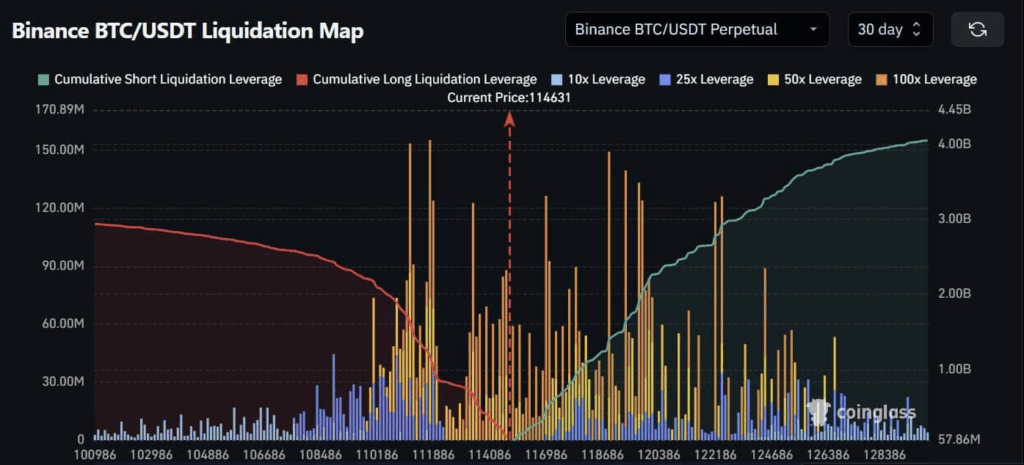

$2 Billion in Shorts at Risk Near $120K

Currently, $2 billion in short positions are stacked around the $120,000 level. If Bitcoin climbs to that range, it could trigger a short squeeze, forcing traders to exit and potentially driving prices up rapidly.

The setup is clear: major capital has arrived, on-chain activity is cooling, and leveraged positions are exposed — Bitcoin’s next breakout may only be a matter of time.

Comments are closed.