Featured News Headlines

BERA Analysis- What’s Driving BERA’s Rapid Ascent?

BERA Analysis– Memecoins are leading the charge in the latest crypto market rally, and Berachain (BERA) is quickly becoming a standout performer. While SPX6900 posted a 21% gain, BERA followed closely with a 20% surge, fueled not just by hype—but by powerful on-chain fundamentals.

On-Chain Strength Backs the Rally

Unlike many meme tokens riding only on sentiment, BERA’s momentum is deeply rooted in on-chain activity. A key driver? A new governance proposal allocating 33% of block rewards to stakers, along with protocol-level token buybacks and a 7-day unbonding period designed to discourage short-term speculation.

These fundamental changes are attracting long-term interest, and it’s showing across the network.

Can BERA Reclaim $3—and Go Beyond?

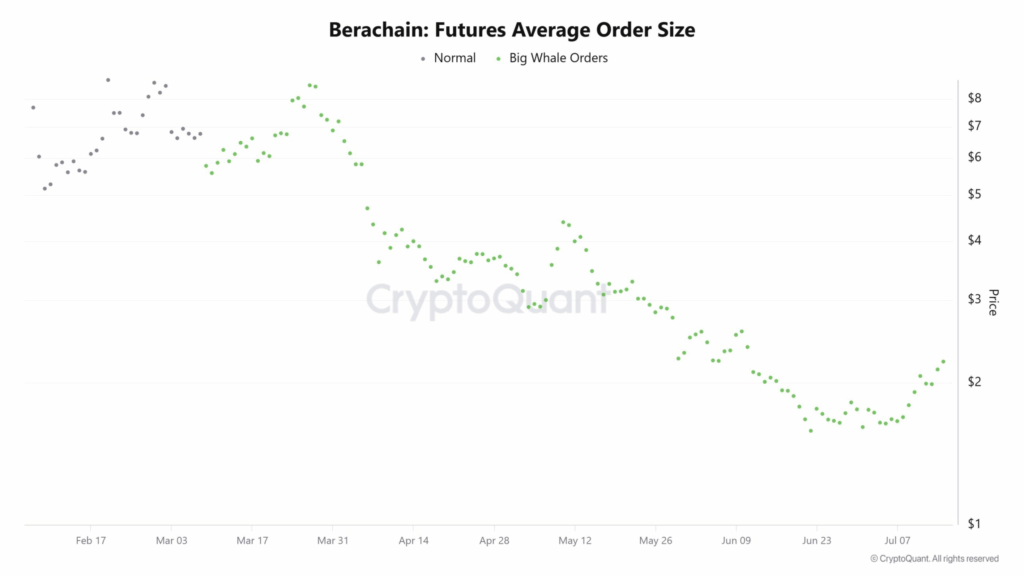

Technically, BERA has broken above its recent lower high, suggesting the potential for a trend reversal. Volume is rising, and the next resistance is at $2.50. A breakout above that could open the door to $3, and potentially $3.5 or even $4.5—levels last seen in April and May.

Still, a failure to hold above $2 could signal a pullback, especially if sellers step in or momentum fades.

On-Chain Metrics Confirm Demand

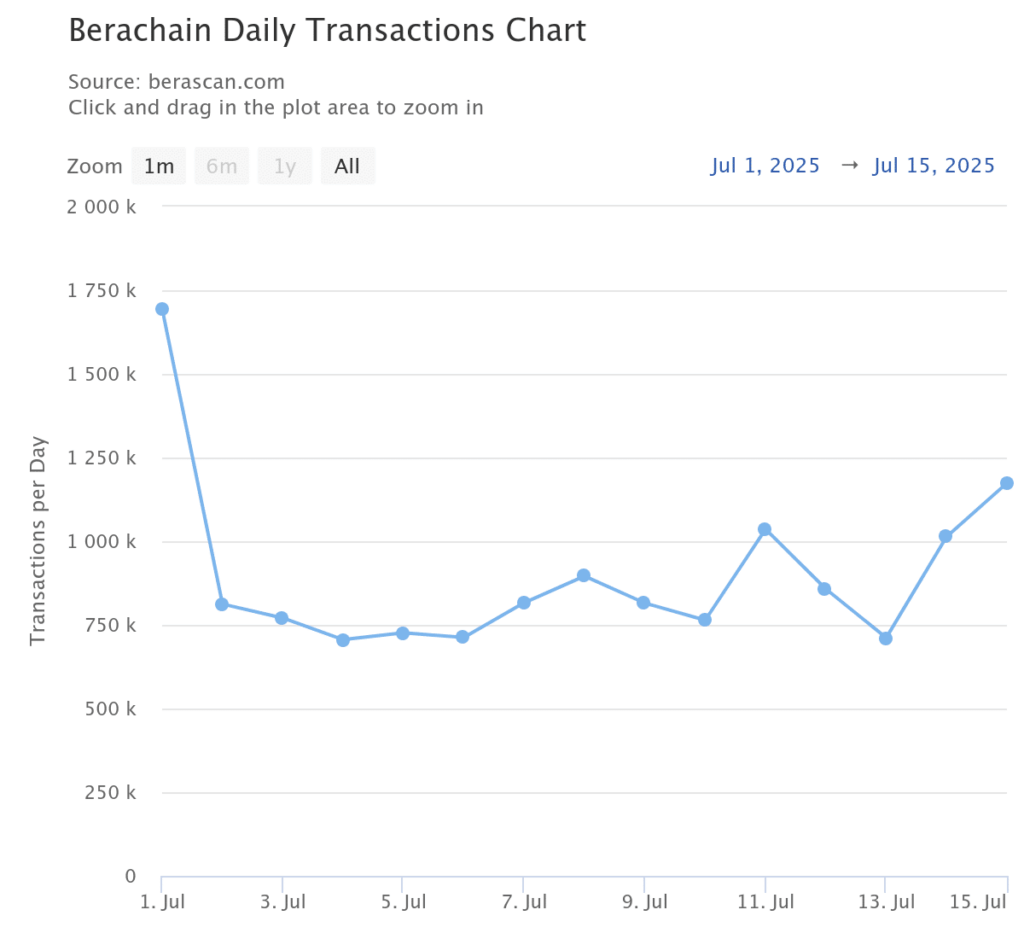

BERA saw a 15.79% jump in daily transactions, totaling over 1.17 million—a clear sign of increasing network use. Wallet growth, contract verifications, and a 1% rise in total gas used all support the narrative of rising demand.

Meanwhile, CryptoQuant data reveals whales are still accumulating, even during recent dips—a strong bullish signal.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.