Featured News Headlines

ASTER Price Faces Pressure as Whale Sell-Off Shakes Market Confidence

Recent on-chain activity has intensified bearish pressure on Aster (ASTER), with large-holder movements shaping short-term price expectations. On December 17, a whale address sold approximately 3 million ASTER, valued near $2.33 million, realizing a reported $667,000 loss. This exit occurred only two weeks after accumulation around the $0.78 level, highlighting how quickly sentiment deteriorated among major holders.

Such behavior often reflects waning confidence rather than opportunistic profit-taking. The timing of the selloff coincided with ASTER losing key support zones, amplifying downside momentum and reinforcing broader caution across the market.

Technical Structure Remains Under Pressure

ASTER continues to trade within a well-defined descending channel, indicating sustained seller control. At the time of observation, price hovered near $0.76, remaining below the 1.618 Fibonacci level at $0.836. This breakdown opens the path toward lower technical zones at $0.741, $0.646, and potentially $0.588.

Momentum indicators remain weak. The MACD structure stays negative, reflecting limited bullish strength, while repeated rejections at channel resistance have capped recovery attempts. Although minor reactions could emerge near lower support levels, broader technical conditions suggest restrained upside potential in the near term.

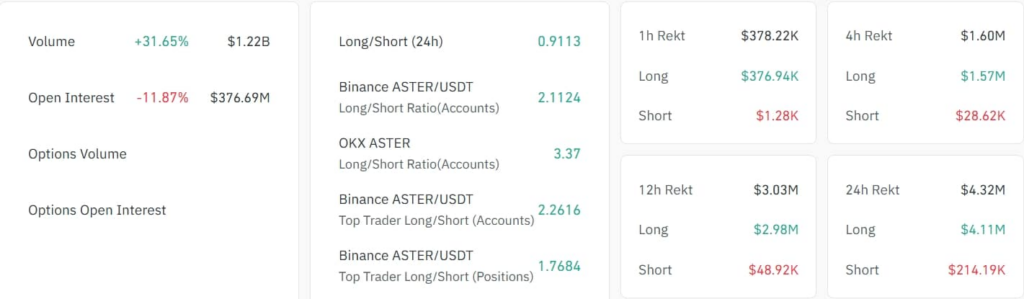

Derivatives Data Reflect Cautious Positioning

Open Interest declined by 3.92% to $420.8 million, signaling reduced exposure across leveraged markets. This contraction aligns with falling demand and suggests traders are closing positions rather than building new ones. While lower Open Interest may reduce the risk of sharp liquidation-driven volatility, it also confirms weakening conviction.

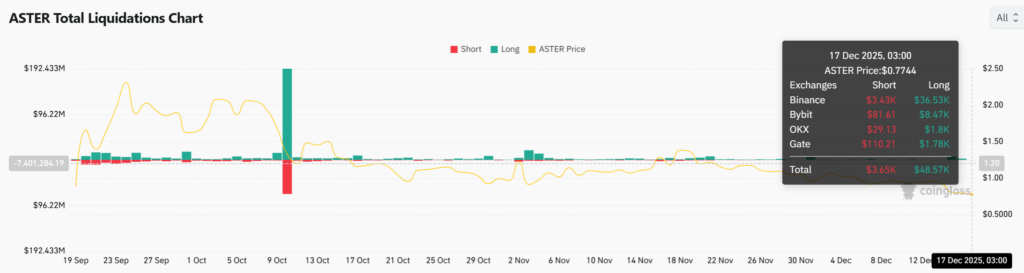

Shorts Gain Control as Liquidations Favor Sellers

Market positioning has shifted decisively bearish. The Long/Short Ratio shows short positions at 58.35%, outweighing longs. Liquidation data further supports this imbalance, with long liquidations significantly exceeding short-side losses. This trend reflects unsuccessful dip-buying attempts and reinforces controlled downside continuation.

Comments are closed.