Featured News Headlines

ASTER Token Distribution Fuels Wild Price Swings and Market Fears

The launch of Aster (ASTER) unleashed extreme market volatility, delivering both rapid gains and sharp corrections in less than three days.

1,700% Rally Followed by Whale-Driven Dump

Within 72 hours of launch, ASTER surged over 1,700% to hit a high of $2, creating multi-million dollar windfalls for early holders. But the parabolic rally quickly reversed. The token fell 15.8% from its peak as whales took profits, including one wallet that reportedly offloaded $60 million in a single day. The sequence mirrored a classic pump-and-dump pattern.

Derivatives Market Signals Greed, Not Strength

Despite the correction, trader appetite remained aggressive. ASTER’s Open Interest in derivatives markets jumped to $822 million, a 31% increase from the previous day. This suggests an influx of $200 million in fresh leveraged positions, likely driven by speculative momentum rather than long-term conviction.

Yet analysts warn this kind of high-beta behavior could trigger further liquidation events if large holders rotate again.

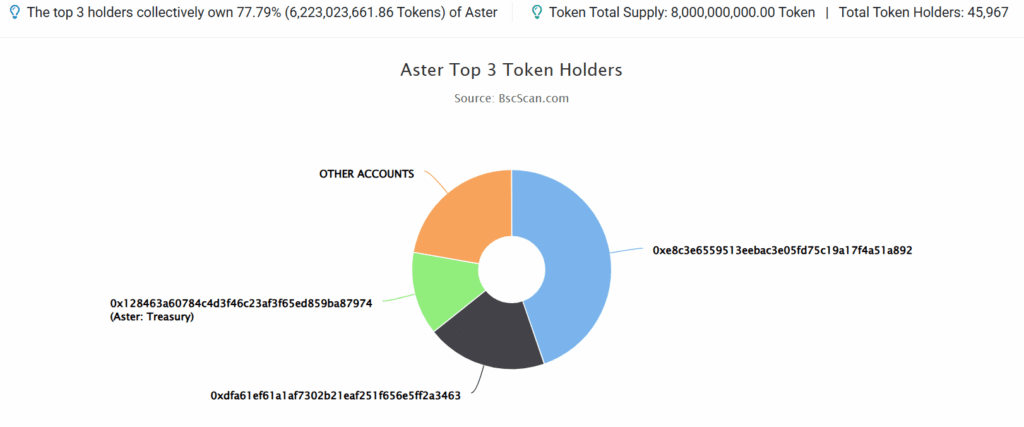

Supply Concentration Raises Manipulation Concerns

The core issue fueling volatility appears to be supply centralization. Of ASTER’s 8 billion total tokens, the top 3 wallets hold 77.9%, and the top 10 control 96%. One wallet alone accounts for 44.7% of the circulating supply.

Such concentration is more typical of small-cap altcoins, and it leaves ASTER vulnerable to sharp sell-offs from a few large players.

Vesting Unlocks Could Accelerate Sell Pressure

Adding to the pressure, ASTER will unlock 53.5 million tokens monthly for the next 80 months, starting mid-October. Analysts suggest even the largest wallets may not absorb this new supply, raising the risk of further downside and increasing fear across the market.

Comments are closed.