SOL Price Alert- Solana’s Critical Resistance Zone

SOL Price Alert– Solana (SOL) is capturing intense attention from high-stakes traders as leveraged positions surge. A recent massive $12 million perpetual futures bet at 10x leverage highlights growing confidence in SOL’s bullish potential.

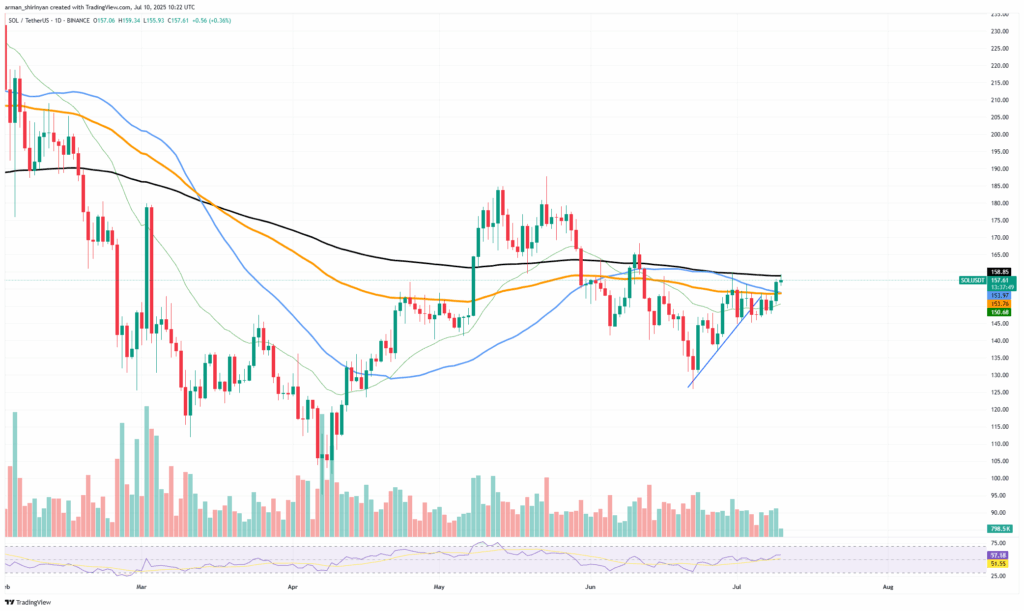

Currently, SOL is consolidating just below key resistance between $155 and $165, hovering near critical moving averages. Technically, the coin has been making steady gains since June lows, forming higher lows and inching closer to the $160 mark. While trading volumes remain solid, they lack the explosive strength seen earlier this year, signaling cautious optimism among spot traders.

However, the whale-sized leveraged position opened at $153 signals a strong conviction that this price zone marks the launching pad for a new upward surge. The path to $200 is challenging, with $175 acting as a major hurdle. Previous break attempts at this level were met with significant pullbacks, reflecting intense selling pressure.

Traders should also watch for resistance near the psychological $200 level, where many expect profit-taking and aggressive short positions to emerge. This could trigger either a powerful breakout or a sharp reversal, depending on market sentiment and volatility spikes.

The Relative Strength Index (RSI) is creeping toward overbought territory, indicating a possible short-term pullback before Solana (SOL) can sustain any further rally. Nonetheless, the dominant trend favors bulls—as long as SOL maintains support above its short-term moving averages and attracts fresh buying interest.

For traders and investors, Solana is at a critical crossroads. Should leveraged whales hold firm and buying momentum overcome resistance, Solana (SOL) could rocket toward $200. But failure to breach this key barrier may swiftly erase recent gains, making the coming days crucial for the token’s next move.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.