Bitcoin Parabola Breaks: Brandt Sounds Alarm

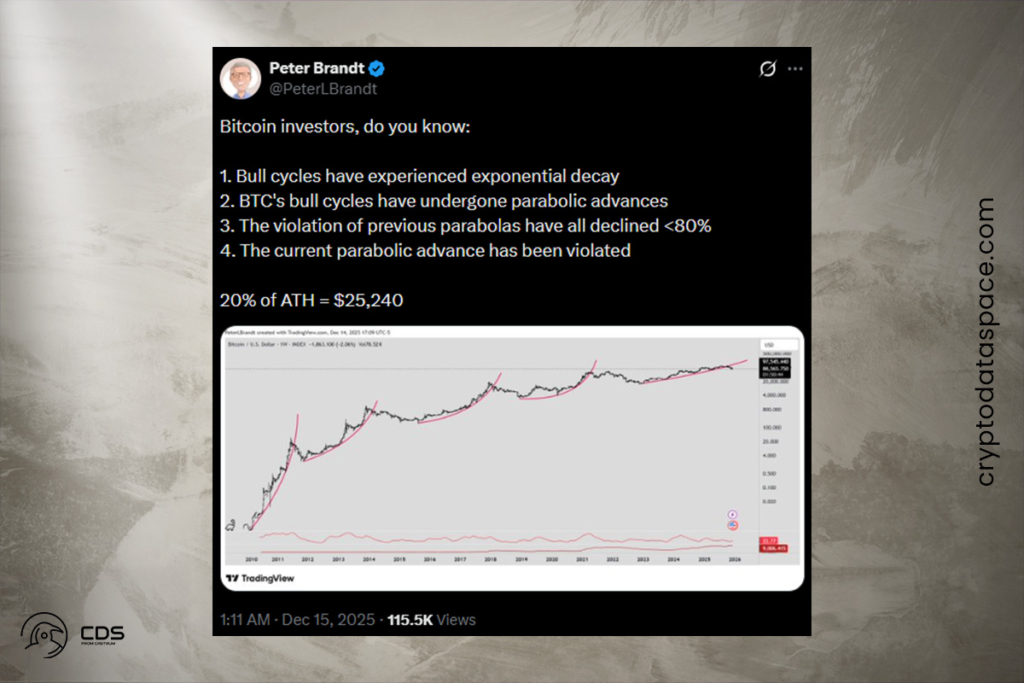

Now that Bitcoin’s parabola has collapsed, renowned commodity trader Peter Brandt has forecast that the price could go all the way back down to $25,240. At the moment, the cryptocurrency is having difficulty breaking beyond the $90,000 mark. Brandt’s primary argument is that Bitcoin’s rapid rise is gradually slowing down. It is maturing but not dying. According to him, this basically indicates that every bull cycle is weaker than the previous one.

Brandt Says Bitcoin’s 100x Era Increase Period Is Likely Over

Bitcoin may have increased 100 times in 2011. About 50x in 2013. 20x in 2017. 10x in 2021. The inference is that investors are misguided if they were hoping for the same crazy 100x returns as in the early days. The market’s thrust, or vigor, is evaporating at an exponential rate. The graph displays the price of Bitcoin over its whole history (2010–2025) on a logarithmic scale. The parabolic growth of Bitcoin is represented by the four pink curving lines. According to Brandt, the price went vertical in four different cycles. The price has crossed below the pink line at the conclusion of the fourth pink curve.

The trend is seen as broken when the price of an asset drops below a parabolic support line. When Bitcoin broke its parabolic curve in 2011, 2013, and 2017, it plunged by at least 80%. For example, Bitcoin fell from $20,000 to $3,200 in 2018. From this perspective, Bitcoin’s value will drop by 80% and retreat to the $25,240 level.

Market Maturity Reshapes Bitcoin’s Risk and Reward Profile

Technically, Brandt‘s projection follows classical market cycle theory, where diminishing returns indicate market maturity rather than structural breakdown. As Bitcoin’s market cap grows, exponential upside becomes mathematically harder to sustain. This leads to lengthier consolidation phases and deeper corrective swings. Late-cycle participants who expect rallies are often frustrated by this changeover.

Long-term investors benefit from market pullbacks because they reset market leverage, eliminate speculative excess, and prepare for sustainable growth. To sum up, whether Bitcoin can replicate parabolic increases is not the crucial variable. The question is whether Bitcoin can attract capital as a macro hedge, digital reserve asset, and portfolio diversifier in a decreasing growth scenario.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.