Featured News Headlines

Cardano Market Shift: From Fear to Optimism as Whales Exit

Cardano’s market dynamics are showing early signs of stabilization after a week marked by intense whale activity. On-chain data now indicates that large holders have slowed their selling, paving the way for smaller investors to step in and absorb excess supply.

This subtle shift from fear to cautious optimism suggests that the market may be transitioning into a new accumulation phase — one that historically precedes recovery periods.

Whales Ease Selling, Retail Accumulates

Over the past week, whales offloaded more than 4 million ADA, sparking renewed debate about Cardano’s near-term trajectory. However, as selling pressure from large holders begins to fade, smaller wallets are showing increased accumulation.

This pattern has often served as a foundation for rebounds in previous cycles, as “whale exits” create more favorable entry conditions for retail investors. The current stabilization near key support zones indicates that confidence is gradually returning.

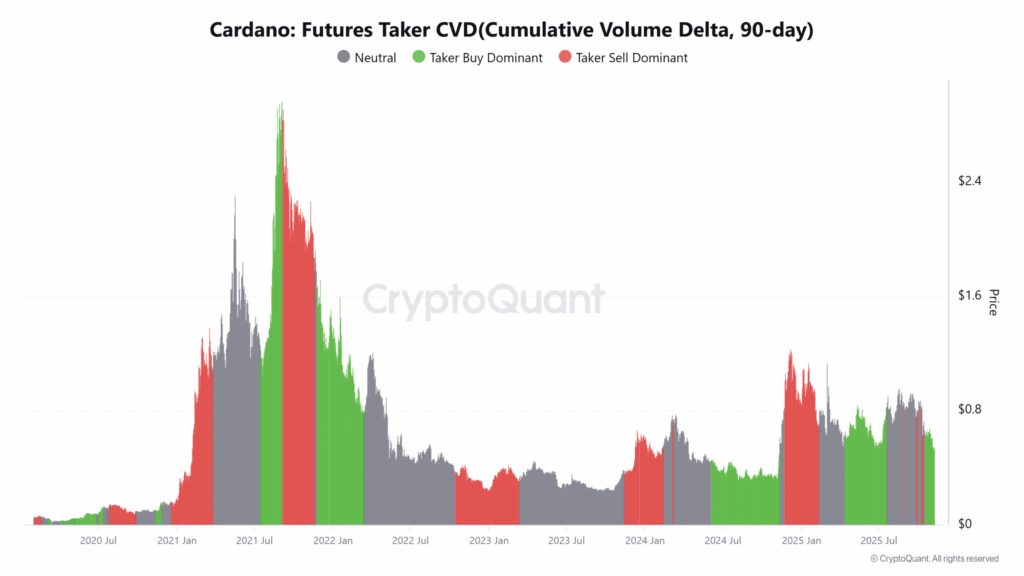

“Taker Buy Dominance” Strengthens in Derivatives Market

Derivatives data highlights a growing appetite among aggressive buyers. According to CoinGlass, short liquidations have surged to roughly $270,000, compared to only $72,000 in long positions.

This imbalance suggests that bearish traders are being squeezed out, while leveraged buyers are gaining control.

Historically, when Taker Buy Dominance strengthens, it often signals the beginning of short-term bullish phases.

The growing presence of leveraged optimism reflects improving sentiment — a key component in the early stages of trend reversals.

Rising Open Interest Reflects Renewed Risk Appetite

Open Interest (OI) has risen by 3.3% to $682.66 million, indicating that traders are reopening speculative positions in anticipation of continued upside momentum.

This OI expansion aligns with stronger taker buy activity, signaling a coordinated return of risk-taking behavior.

However, if ADA fails to overcome the $0.69 resistance, traders could face short-term volatility as positions unwind.

Still, the persistence of positive derivatives signals reinforces that market participants are gradually regaining conviction in ADA’s recovery path.

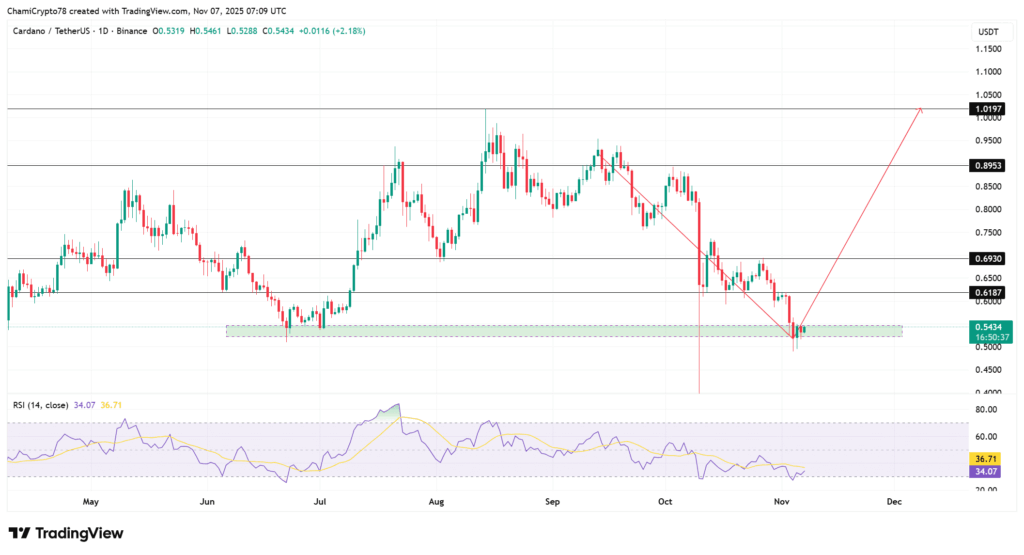

Technical Indicators Hint at a Potential Bottom

From a technical standpoint, Cardano appears to be forming a short-term bottom. Retail accumulation, easing whale pressure, and rising trading volumes near support all contribute to a more constructive setup.

The Relative Strength Index (RSI) remains near oversold levels, suggesting that selling momentum is waning and buyers are regaining control.

If ADA maintains stability above $0.50, it could attract renewed institutional interest and strengthen its bullish structure. Conversely, a breakdown below that zone would signal caution, potentially delaying recovery.

Comments are closed.